Clean Energy + Decarbonisation

Our Approach

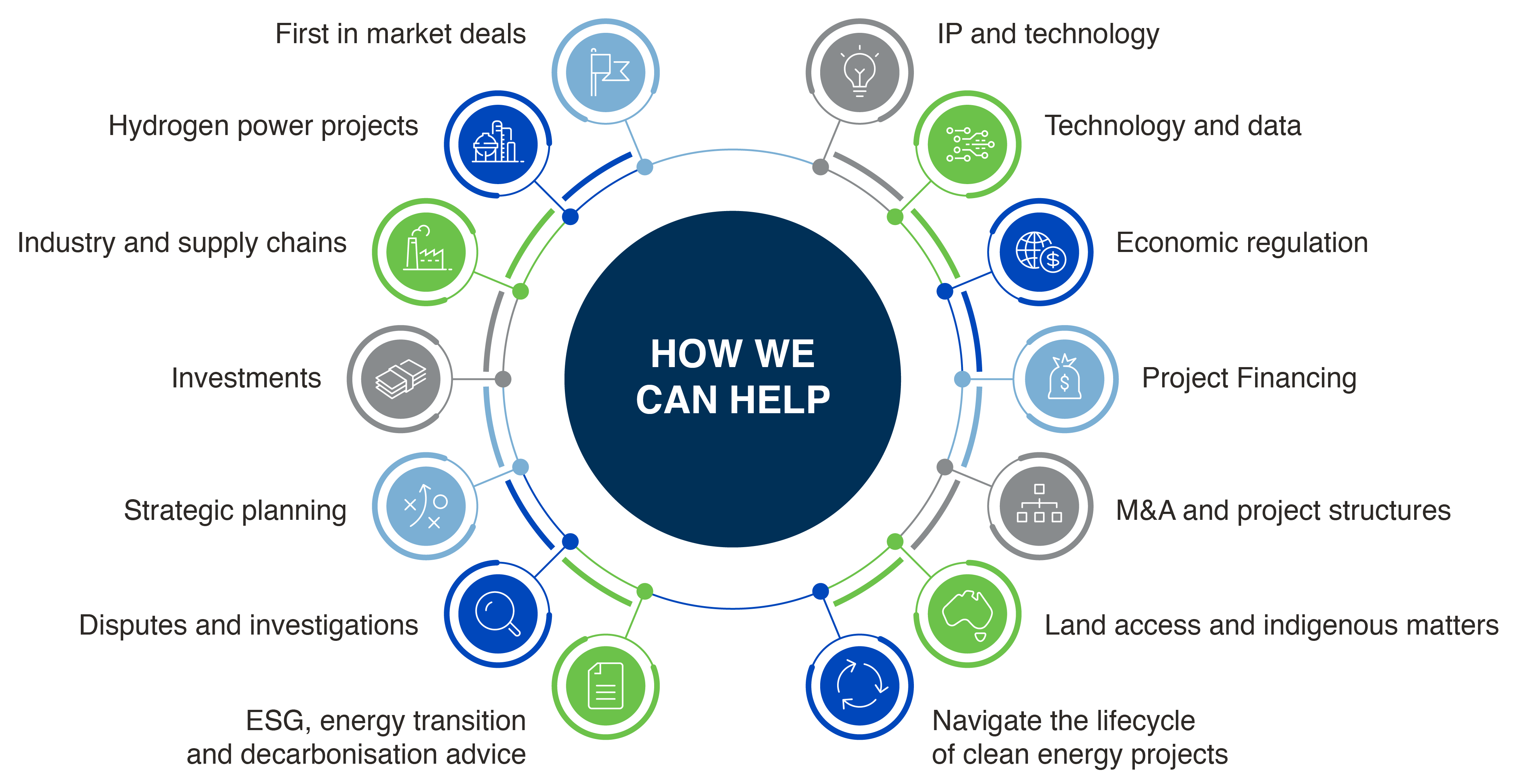

Our multi-disciplinary team includes energy and resources, infrastructure and projects, banking, competition, environment, corporate advisory, technology and regulatory specialists with a deep understanding of the complex issues involved in clean energy projects and the transition to a lower emissions economy.

Specialist Services:

- Hydrogen power projects and supply chains: The establishment of Australia’s clean hydrogen potential, including the design and implementation of hydrogen power projects and industry and supply chains powered by renewables and low emission technologies.

- Water production, treatment and storage solutions for resources infrastructure and social purposes including waste-to-energy facilities.

- Clean energy projects: including renewables (wind, solar, pumped hydro, hydrogen and emerging technologies such as floating offshore wind farm developments), battery storage and behind-the-meter projects.

- ESG, energy transition and decarbonisation advice: Advising directors of listed and unlisted companies on their duties, liabilities and protections in relation to ESG, energy transition and decarbonisation issues including advising ASX100 clients on responses to ASIC’s investigation of large corporates’ disclosure and risk management practices into climate change.

Our Experience

- First in market deals: assisting with high value, complex and innovative “first in market” deals for sponsors, contractors, financiers and others driving the energy transition.

- M&A and project structures: Acquisitions, disposals, joint ventures, development, construction, procurement, operation and maintenance, long term off-take agreements and commercial contracting.

- Investments: Investments in environmental markets and carbon abatements businesses.

- Technology and data: The use of new technologies and data in an infrastructure environment, enabling more innovative, better connected, more robust, smarter and greener infrastructure including market leading initiatives and drawing on world first technologies in the transport and electric vehicle sectors.

- IP and technology commercialisation, including research & development, IP collaborations, and patent and technology licensing in respect of emerging technologies. This includes new solar technologies, battery / energy storage solutions, hydrogen technologies and carbon sequestration.

- Project Financing: including acquisition and leverage finance, corporate finance and all aspects of project and infrastructure related financing or sponsors, banks and private equity firms.

- Economic regulation: Economic regulation, competition and access matters in relation to energy infrastructure.

- Network regulation, including price regulation, connection processes for new generation facilities, system strength and reliability obligations, and approval processes for network augmentation and expansions.

- Evolution of energy regulatory frameworks to reflect system transformation. This includes numerous rule change processes designed to accommodate the integration of distributed energy resources and address associated system strength and security of supply issues.

- Pipeline access matters.

- Gas pricing matters, including contractual price reviews and disputes.

- Compliance with technical rules relating to electricity generation in Australia’s electricity markets, including the NEM and WEM.

- Registration, accreditation and licencing requirements for all types of market participants in Australia’s electricity markets including generators, retailers and traders.

- Compliance with rules relating to electricity and gas retailing, including the NECF, Victoria’s Energy Code, the retail pricing prohibition in the federal “big stick” legislation and advertising rules in the Electricity Retail Code.

- Misleading and deceptive advertising issues associated with green, renewable and carbon neutral characteristics of energy products.

- Land access and indigenous matters: Land access, native title and Aboriginal heritage, including negotiating with and for traditional owners and other stakeholders, in relation clean energy and hydrogen projects.

- Strategic planning: Planning and environmental advice in relation to all aspects of clean energy projects.

- Disputes and investigations: Disputes and investigations arising from the evolving compliance framework faced by directors and companies as well as advice relating to ESG related shareholder activism.

Key Contacts