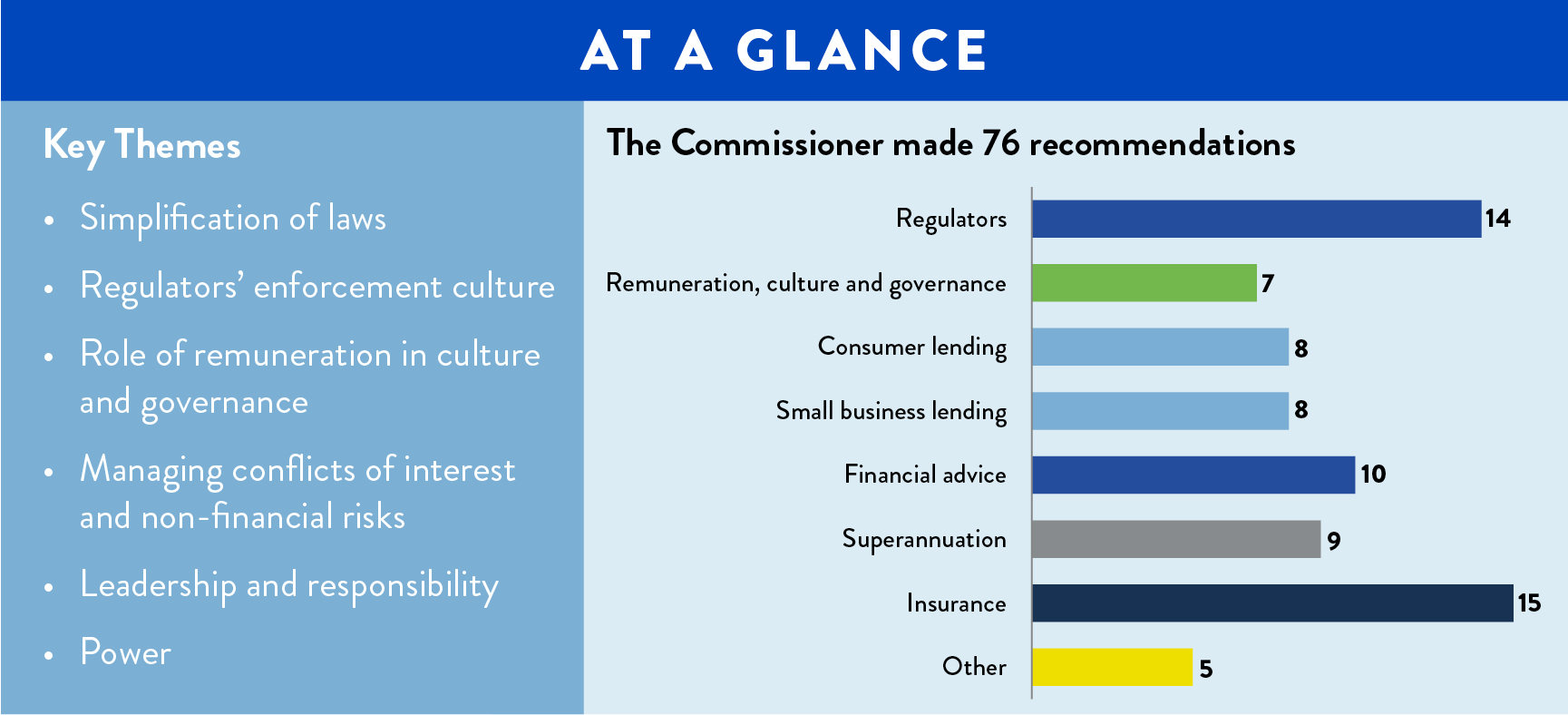

On 4 February 2019, the Government publicly released Commissioner Hayne’s Final Report (Report) in the Royal Commission into Misconduct in the Banking Superannuation and Financial Services Industry, representing the culmination of one of the most important public inquiries in Australian history, which has already fundamentally influenced and altered bank and corporate culture, and will continue to do so. The Commission’s work spanned more than 12 months, which included 69 days of public hearings and evidence from more than 250 witnesses across consumers, financial services entities, regulators and community and industry groups. The Report is almost 1000 pages long, and includes 76 recommendations and 19 referrals of entities to regulators for further action.

The Report will no doubt lead to significant debate and important change among lawmakers, industry, regulators and the community. In the Commissioner’s view, much of the potential misconduct identified by the Commission was already contrary to the law. Consistent with that, many of the recommendations focus on enforcing, and complying with, existing laws, including by:

- focusing on culture, governance and non-financial risks within financial services entities, including by reviewing remuneration and incentive structures (which the Commissioner concludes were key factors in much of the misconduct identified);

- changing the enforcement culture among regulators – promoting litigation as the default enforcement outcome (rather than negotiated outcomes, infringement notices and enforceable undertakings);

- reducing the power imbalance between financial services entities and consumers; and

- simplifying (rather than adding to) the matrix of financial services laws.

By contrast, structural changes recommended by the Report are more limited. For example, having examined these matters in length during the hearings and through submissions, the Report does not recommend:

- mandated changes to remuneration structures (beyond existing recommendations put forward by the Sedgwick review);

- restructuring or reallocating ASIC’s regulatory remit;

- changes to the use of benchmarks or other significant changes to responsible lending laws and processes;

- applying the consumer lending ‘responsible lending’ obligations to small business lending; or

- structural changes which would prohibit vertical integration in financial advice and superannuation businesses, or prohibit for-profit superannuation funds.

That said, the Report makes a number of recommendations which would have significant and immediate effects to financial services entities and the industry if implemented. Key recommendations include:

- changes to the mortgage broking model, including payment of broker fees by borrowers rather than lenders, and the imposition of financial advice-style obligations on brokers. The Government has indicated, though, that it will not adopt this recommendation in light of the anticipated effects on competition;

- removal of the point of sale exemption for retail car dealers, which would require car dealers to adhere to responsible lending obligations if facilitating auto loans (and, if applied more broadly, this reform could extend the same obligations to anyone offering credit at the point of sale, such as department stores and other retail vendors);

- reforms to ongoing financial advice fees, including requiring an annual ‘opt-in’ by the client (the Commission having examined ‘fee for no service’ issues in detail and being highly critical of a number of organisations in the Report);

- prohibiting ‘dual regulated entity’ structures (for example, where one entity is both a superannuation trustee and responsible entity of a managed investment scheme); and

- removing exceptions to prohibitions on conflicted remuneration. The Government has already announced that it intends to remove grandfathered exceptions by 2021.

These matters are discussed in more detail below.

- At a glance

- Regulators

- Remuneration, Culture and Governance

- Consumer Lending

- Small Business Lending

- Financial Advice

- Superannuation

- Insurance

- Other

At a Glance

Regulators – 14 recommendations

- Increased use of litigation as enforcement strategy.

- Retention of ‘twin peaks’ model of prudential (APRA) and conduct (ASIC) regulation. No material changes to ASIC’s remit.

- Independent oversight body to review regulators.

Remuneration, culture and governance – 7 recommendations

- Remuneration structures perceived a key limb of the root causes of misconduct.

- No mandated changes to remuneration models, but annual reviews by entities and more active oversight by APRA recommended.

- Consider clawbacks on vested financial reward and greater transparency of risk adjustments to remuneration

Consumer lending – 8 recommendations

- No changes to the responsible lending framework, including the use of benchmarks like HEM.

- Significant changes to the mortgage broker industry including the introduction of a ‘best interests’ duty, abolition of trail commissions; and requiring the borrower, not the lender, to pay the broker’s fees.

- Removal of the point-of-sale exemption to responsible lending laws for retail dealers in the auto finance industry.

Small business lending – 8 recommendations

- Change the definition of small business to any business or group employing fewer than 100 full-time equivalent employees, where the loan applied for is less than $5 million.

- No changes to the way that guarantees are taken or enforced.

- The NCCP should not be extended to small business lending.

Financial advice – 10 recommendations

- Reform ongoing advice fee arrangements – annual ‘opt in’. ‘Fee for no service’ issues heavily criticised.

- Review and repeal of exceptions to prohibitions on conflicted remuneration.

- No mandated structural separation recommended.

Superannuation – 9 recommendations

- No prohibition on retail superannuation funds or structural separation between product manufacturers and distributers.

- Prohibit ‘dual regulated entity’ structures (where one entity is both a superannuation trustee and MIS responsible entity).

- Significant restrictions on deduction of advice fees and unsolicited sales practices.

Insurance – 15 recommendations

- Expand anti-hawking provisions.

- Application of unfair contracts regime to insurance, and removal of claims handling exemption from s912A.

- Tighten life insurance avoidance provisions.

- Deferred sales model for add-on insurance.

Other – 5 recommendations

- Financial services laws should be simplified and identify ‘fundamental norms’ of behaviour.

- Require regulator approval for all industry codes.

- Establish compensation scheme of last resort.

Regulators

The Commissioner considered the remit and regulatory culture of ASIC and APRA, the interaction between the two regulators, and measures for improving their effectiveness and oversight. He was critical of the performance of the regulators, and in particular what he viewed as an excessive readiness to pursue negotiated outcomes with the regulated community.

Having considered proposals for the creation of a new conduct regulator or otherwise restructuring ASIC’s role, however, the Commissioner concluded that the issues lie with ASIC’s enforcement culture, rather than its remit. As such, the recommendations:

- support the prevailing ‘twin peaks’ model of regulation with APRA as the prudential regulator and ASIC as the conduct regulator, and propose amendments which would strengthen ASIC’s ability to regulate conduct in superannuation and the Banking Executive Accountability Regime (BEAR);

- suggest formalised measures to require and regularise cooperation between APRA and ASIC; and

- promote changes to ASIC’s enforcement approach, including:

- starting from the premise ‘why not litigate’;

- reducing the use of infringement notices and enforceable undertakings; and

- emphasising the importance of publicly denouncing misconduct and clarifying laws and norms.

In support of these changes, the Report also recommends the establishment of an independent oversight body to periodically review the regulators, and other measures designed to improve their effectiveness and governance.

The role and approach of regulators will be a an important consequence of the Commission and all financial institutions can expect significantly more attention and vigour from both key regulators. Indeed, these changes were underway in response to the work of the Commission before the publication of the Report.

Remuneration, Culture and Governance

Remuneration structures were a central focus of many of the case studies examined by the Commission and, consistent with observations in the Interim Report, the Commissioner concludes that incentive and remuneration structures played a significant role in much of the misconduct identified. That said, the recommendations on this issue are relatively high-level and would not outlaw existing remuneration structures or mandate other changes:

- the Commissioner recommends that the recommendations of the Sedgwick review be fully implemented, and that financial services entities review their remuneration structures annually with a focus not only on “what” employees are doing, but “how” they do it;

- APRA should take a more active role in ensuring that remuneration structures pay due regard to both financial and non-financial risks; and

- the Report emphasises the role of boards in monitoring and designing remuneration structures and steering the culture of the organisation.

Consumer Lending

The focus of the Report with respect to consumer lending was on the role of intermediaries, with relatively little commentary about the content or application of responsible lending laws more generally. In particular:

- Responsible lending: Despite the intense scrutiny of responsible lending obligations by Counsel Assisting during the public hearings, the Commissioner made no recommendations in relation to the use of benchmarks (such as HEM) or other aspects of responsible lending obligations. In particular, the Commissioner recommended that the National Consumer Credit Protection Act (NCCP Act) should not be amended to alter the obligation to assess unsuitability, and that there was no need to adjust the definition of the ‘diligent and prudent’ banker in the Banking Code of Practice.

- Mortgage Brokers: Some of the most significant recommendations for change relate to the mortgage broking industry. In the Commissioner’s view, intermediaries invariably act for the entity that pays them and prefer the interests of those entities to the interests of customers. In light of these observations, the Commissioner recommended, among other things, that:

- mortgage brokers, when acting in connection with home lending, must act in the best interests of the intending borrower, and that failure to do so should be a civil penalty provision (which would entail the imposition of a significant new obligation on brokers);

- over a two to three year period, trail commissions to mortgage brokers be abolished; and

- borrowers should pay the mortgage broker’s fee for acting in connection with the loan.

Such changes would represent a significant departure from current practice and significantly alter the business model of mortgage brokers. In response to the recommendations, the Government has indicated it would introduce a duty for mortgage brokers to act in the best interests of borrowers, but would not adopt changes to broker fee structures in light of the anticipated effect that would have on the viability of the sector and competition in the industry.

- Auto Finance: The Report recommends the removal of the point-of-sale (POS) exemption for retail detailers from operation of the NCCP Act. In the Commissioner’s view, the apparent conflict for dealers operating under the POS exemption is untenable. The effect would be to make car dealers responsible for satisfying responsible lending requirements when facilitating auto loans. Depending on how the recommendation were implemented, it could have a much broader effect to apply to all POS retail credit transactions (such as department store purchases on credit).

Despite the attention paid to flex commissions in the Interim Report, no recommendations were made given ASIC had already intervened, with such commissions prohibited since November 2018.

Small Business Lending

During the third and fourth rounds of hearings, the Commissioner explored issues relating to lending to small businesses and agricultural businesses, including issues around the definition of small business, farm debt mediation and industry codes. Broadly speaking, the Commissioner’s findings concerned:

- Definition of small business. The Commissioner considered that the definition of ‘small business’ under the Banking Code of Practice was too complicated and also too confined in its reach. The Commissioner recommended that the definition set out in the Khoury Review should be adopted. The Khoury Review defined small business as any business or group employing fewer than 100 full-time equivalent employees, where the loan applied for is less than $5 million. This recommendation is opposed by the Australian Banking Association.

- Enforceability of industry codes. One of the issues identified by the Commission was that industry codes were not enforceable under law. The Commissioner recommended that the laws should be amended to provide that industry codes are approved by ASIC, and be enforceable as a breach of statute.

- Farm debt mediation. There are currently inconsistent approaches to farm debt mediation by the States and wider issues in relation to the regulation of agri-business loans. To address these issues, the Commissioner recommended that a national scheme of farm debt mediation should be put in place.

While the Interim Report contained detailed discussions and invited submissions on guarantees and the extension of the NCCP Act to small business, the Commissioner made no recommendations in relation to guarantees, and, consistent with the position in the Interim Report, expressly recommended that the NCCP Act not be amended to extend its operation to small business lending.

Financial Advice

Financial advice generated significant attention, both during the hearing dedicated to the topic, and in subsequent rounds focused on superannuation and insurance. In particular, the Commissioner is highly critical of ‘fee for no service’ issues arising from the management of ongoing advice fee arrangements throughout the industry. To that end, the Report recommends significant reforms to such arrangements, including that they be renewed annually with express authorisation from the client.

The Report also includes a range of other recommendations designed to expand the coverage of the Future of Financial Advice reforms and improve the professionalism of the advice industry, including:

- removing exemptions on the ban on conflicted remuneration. The Government has announced that it intends to remove grandfathered exceptions by 2021;

- reviewing conflicted remuneration exceptions in relation to the distribution of insurance;

- enhanced disclosure of circumstances in which an adviser may not be acting independently in the provision of advice; and

- enhanced obligations to report compliance concerns about financial advisers.

Superannuation

Much of the Report’s examination of superannuation focuses on the management (or, in some cases, eradication) of conflicts of interest. The position of retail super funds attracted significant attention during the hearings. The Report finds, however, that potential conflicts in that structure are manageable, and makes no recommendation about restricting vertical integration or the use of related party suppliers. The Commissioner cautions, however, that close scrutiny is required to ensure that the arrangements comply with the members’ best interests, and that disclosure of the potential conflicts is not sufficient to manage any conflicts.

Significantly, though, the Report finds that potential conflicts within dual regulated entity structures are unmanageable and that they should be banned. The main practical effect would be to prohibit superannuation trustees from also being the responsible entity of a managed investment scheme, which is a model used in the industry in a variety of circumstances.

The Report also makes important recommendations about the sale and administration of superannuation products and related services, including that:

- apart from intra-fund advice fees, no advice fees should be deducted from MySuper funds, and that ongoing advice fees deducted from choice accounts should be tightly controlled (in a manner which would likely affect most existing arrangements);

- ‘hawking’ (ie unsolicited sales) of superannuation products be prohibited. The Commissioner’s focus appears to be on cross-sales (eg with credit cards), but this may also affect intra-organisation referrals; and

- one default account should exist for each person, which carries over as members move jobs (also described as being ‘stapled’).

Insurance

The Commissioner’s examination of the insurance industry in the Report can be summarised in three broad themes:

- Sales practices: the Report identifies sales practices as a key cause of consumer detriment. It has recommended the prohibition of any unsolicited sales of insurance products, and the introduction of a deferred sales model for add-on insurance products. The Commissioner is also clearly of the view that exceptions to conflicted remuneration prohibitions for insurance should be abolished, though stopped short of recommending that (recommending instead that the existing commission caps and other arrangements be reviewed).

- Contract terms: The Report includes a number of recommendations relating to the way in which insurance contract terms are negotiated and enforced. In particular, the Report recommends extending the unfair contract terms regime to insurance contracts, tightening life insurance anti-avoidance provisions, and a review of the viability of standardised definitions (though does not go as far as recommending that they be introduced).

- Regulation: The Report proposes stricter regulation of the industry, including by removing the claims handling exception to the scope of s912A of the Corporations Act, and making industry codes mandatory and enforceable.

Other

As an overarching recommendation, the Commissioner recommends that laws be simplified and look to identify fundamental norms of behaviour that they seek to influence. Other recommendations of note include:

- the extension of the BEAR to all financial services entities (as well as imposing an analogous regime on the regulators); and

- the introduction of a compensation scheme of last resort.

Visit SmartCounsel