This is Part Two of our four-part series on the impact of the findings and recommendations of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (the Commission). You can find Part One here.

There are tax implications arising from actions taken before and as a consequence of the Commission. This Part looks at some of those tax implications, with a particular focus on customers rather than the financial institutions, although financial institutions should have regard to these impacts in taking remedial actions. The Australian Taxation Office (ATO) may well form its own views in this area, but each taxpayer’s circumstances will be different.

Key takeaways and action items

- Taxpayers should consider their own particular circumstances in determining the tax implications of any compensation or refunds received. There may be some scope for structuring the compensation appropriately with the financial institutions to mitigate any inadvertent tax outcomes.

The role of financial institutions and intermediaries

Although this Part does not look at the tax treatment for financial institutions and intermediaries, they do have a part to play in mitigating adverse tax consequences for their customers from remedial actions taken in response to the Commission. For example, the structure of compensation payments and future advice fees will have a tax impact for their customers. The size of the task that the financial institutions and intermediaries face in redressing the issues identified by the Commission will likely determine how customised they can be to mitigate the impact on customers.

Compensation and refunds

The Commission has identified a number of instances where compensation (including a refund of fees wrongly charged) has been or must be paid. Further, a class action has been commenced against a certain financial institution, which may result in compensation being paid.

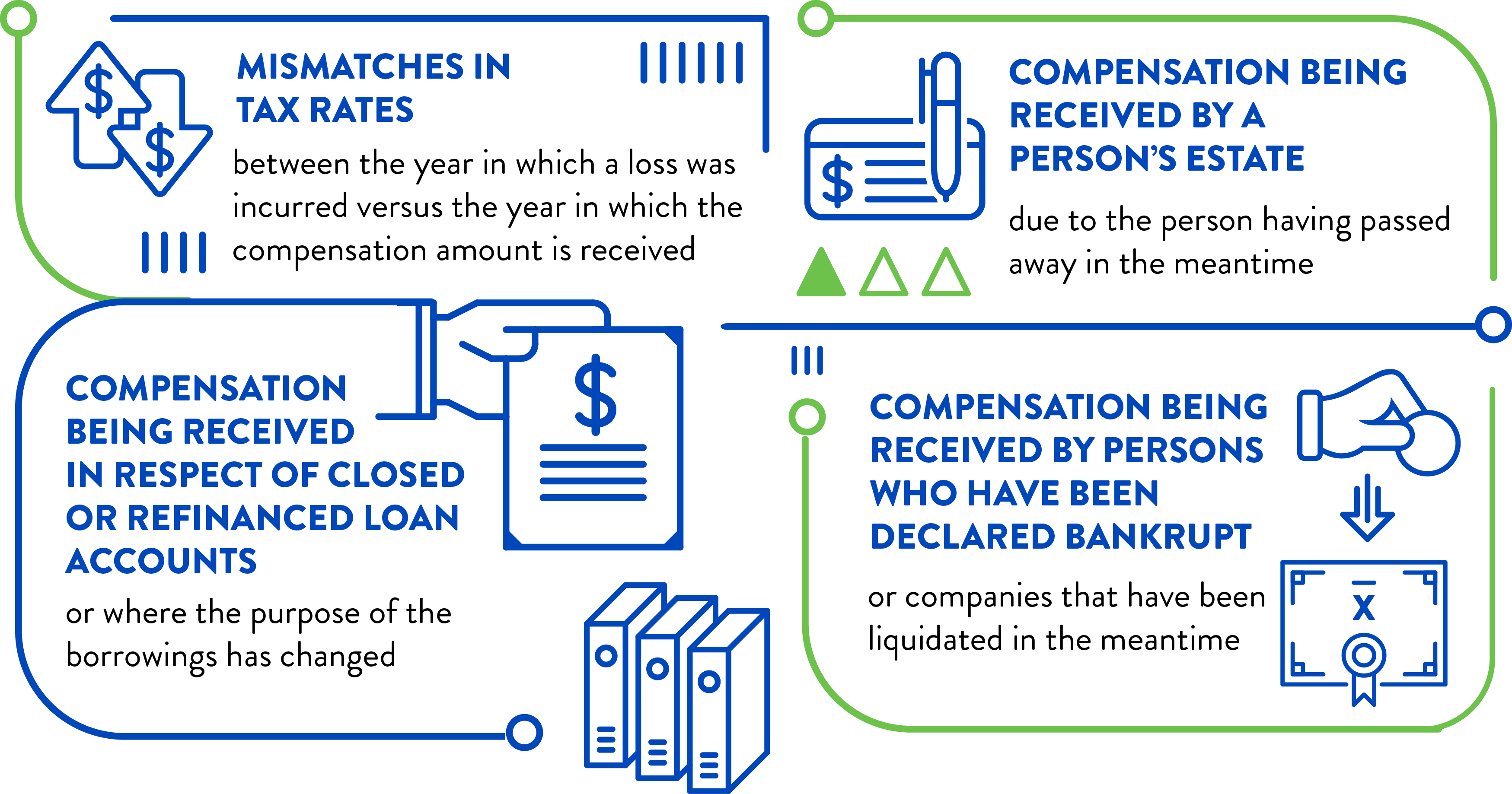

The tax treatment of the receipt will depend on the original arrangement or purposes. The tax implications will be affected by factors such as:

Compensation for losses suffered as a result of poor advice may be in respect of economic losses (for example, lost dividends, lost gains) rather than be of the kind that resulted in tax losses or capital losses. If the compensation is for such economic losses, and the compensation amount is undissected, the ATO may view the compensation as a capital receipt for discharge of a cause of action. In that circumstance, the ATO is likely to view the cause of action as having been suffered when the losses were incurred, which is important to assessing the eligibility for the capital gains tax (CGT) discount.

Where the compensation recoups tax deductions, tax losses or capital losses, the ATO may view the compensation as an assessable revenue receipt or a capital gain. Again, the eligibility for the CGT discount will need to be considered.

Compensation for incorrect interest rates on loan accounts is likely to follow the underlying treatment of interest on those accounts. Where the loan was used to purchase income producing assets, the compensation is likely to be assessable. Where the loan was used for private purposes, the compensation is unlikely to be assessable. However, consideration should be given to whether a capital gain could arise for surrendering (that is, disposing of) a cause of action. Complications can also arise in the specific circumstances described in respect of compensations and refunds above.

Compensation for fees wrongly charged is likely to follow the underlying treatment of fees. Fees incurred in the provision of general financial and insurance strategies for individuals are unlikely to be deductible; therefore, compensation should not be assessable. To the extent deductions were in fact claimed for such fees, the compensation should then be assessable to that extent. If the fees increased the cost base of assets, the compensation may reduce the cost base of assets on hand or result in a capital gain. Eligibility for the CGT discount will need to be considered.

The particular circumstances of taxpayers may mean that the tax treatment of compensation receipts has a bearing on their superannuation and social security entitlements.

Fees

The Commission has recommended changes to fee arrangements for brokers (including mortgage brokers) and financial advisers. As these will be new fees incurred by taxpayers, consideration should be given to their tax treatment.

Fees incurred on financial advice that relates to an individual’s general financial and insurance strategy, as opposed to specific income-producing investments, are unlikely to be deductible. However, investment-specific costs may be deductible or be added to the cost base of those investments.

Other observations

The Commission drew attention to the fact that even professional trustees failed to understand their duties as trustees, particularly in the context of superannuation. In particular, “[i]t should be concerning to regulators that professional trustees apparently struggle to understand their most fundamental obligation. … The concept of acting in members’ interests is not hard to understand.”

In the case of self-managed superannuation funds, it is likely that this is not too much of a concern given the limited class of beneficiaries of such funds. However, it is reasonable to expect that the ATO would take an interest, particularly where there are other questionable activities.

The Commission notes that advice fees, particularly ongoing advice fees, were often charged to superannuation accounts. The Commission notes that these fees were charged under a contract entered into between the superannuation fund’s member and the financial adviser, not between the fund itself and the adviser. The discussion implies that the fees are related to the member’s broader financial affairs, not the superannuation fund’s activities.

It is conceivable that those fees are not technically deductible within the superannuation account, but that a tax deduction has in fact been claimed within the account. Further, depending on invoicing, it is conceivable that a separate deduction for the same amount could have been claimed by the individual member. Superannuation fund trustees should consider whether such fees have been correctly treated.

The Commission has recommended changes to lenders’ approach to distressed agricultural loans. The tax treatment will depend on how lenders approach these changes. One conceivable impact is that any deemed debt forgiveness is postponed or avoided, which could prevent a loss of tax attributes, thereby ensuring tax does not become payable inadvertently.

Implications for tax professionals

In Part Three of this series, we will look at the Commission's impact on tax professionals and their relationship with clients and the community.

Visit SmartCounsel