Key Messages

• On 3 December 2018, the ACCC submitted to the Treasurer its preliminary report on the Digital Platforms Inquiry, which was publically released on Monday 10 December 2018.

• The ACCC expressed its strong conclusion that both Google and Facebook have substantial market power. As it has done in other inquiries, the ACCC uses this conclusion as a basis for recommending far-reaching regulatory changes, going well beyond the existing, generally applicable, regulatory framework within the Competition and Consumer Act (CCA).

• The ACCC has made 11 preliminary recommendations, which would include amendments to the Privacy Act, the CCA and the Australian Consumer Law (ACL). Importantly, these recommendations would apply to all businesses, not just digital platforms (with or without market power).

• The ACCC has also flagged 5 ongoing investigations into potential breaches of the CCA and ACL, including four instances involving actions taken in relation to the privacy policies of digital platforms – the first time the ACCC has publicly announced an investigation into potential breaches of the ACL relating to privacy policies.

The story so far

On 4 December 2017, the Treasurer directed the ACCC to conduct a “world first” public inquiry into the impact of digital platform services on the state of competition in media and advertising services markets in Australia.

In February 2018, the ACCC released its issues paper focussed on digital platforms’ market power and the impact of digital search engines, social media platforms and other digital content aggregation services on consumer rights, advertising and the creation and consumption of news.

Since February, the ACCC has published 75 submissions to the inquiry, held four stakeholder forums (for each of consumers, journalists, advertisers and corporate stakeholders), commissioned consumer research and used its broad investigation powers under section 95ZK of the CCA to gather information from digital platforms, media publishers and advertisers.

Findings and preliminary recommendations

Google and Facebook have market power

The ACCC’s central finding is that Google and Facebook have substantial market power in Australia. It is therefore proposing far-reaching and unprecedented reforms to the way digital platforms are regulated under Australia’s competition and consumer laws. This stark conclusion rests on the following primary factual findings:

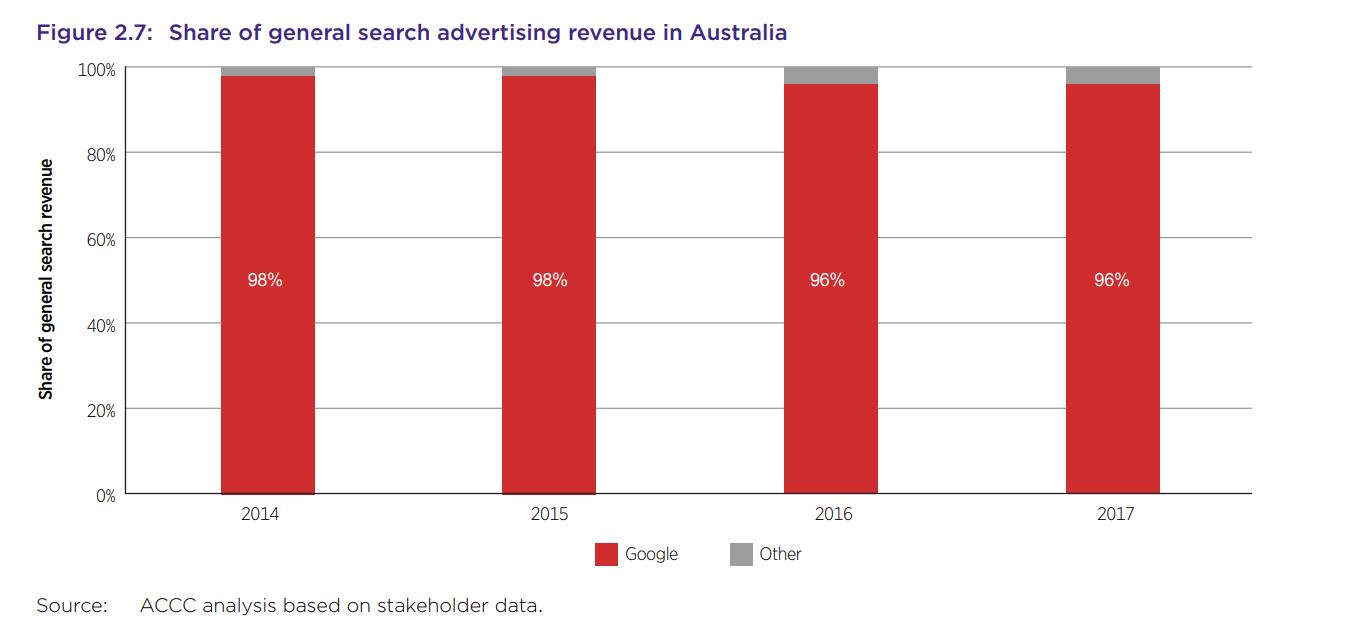

- Google has a dominant share of search services and search advertising in Australia (ACCC Figure 2.7); and

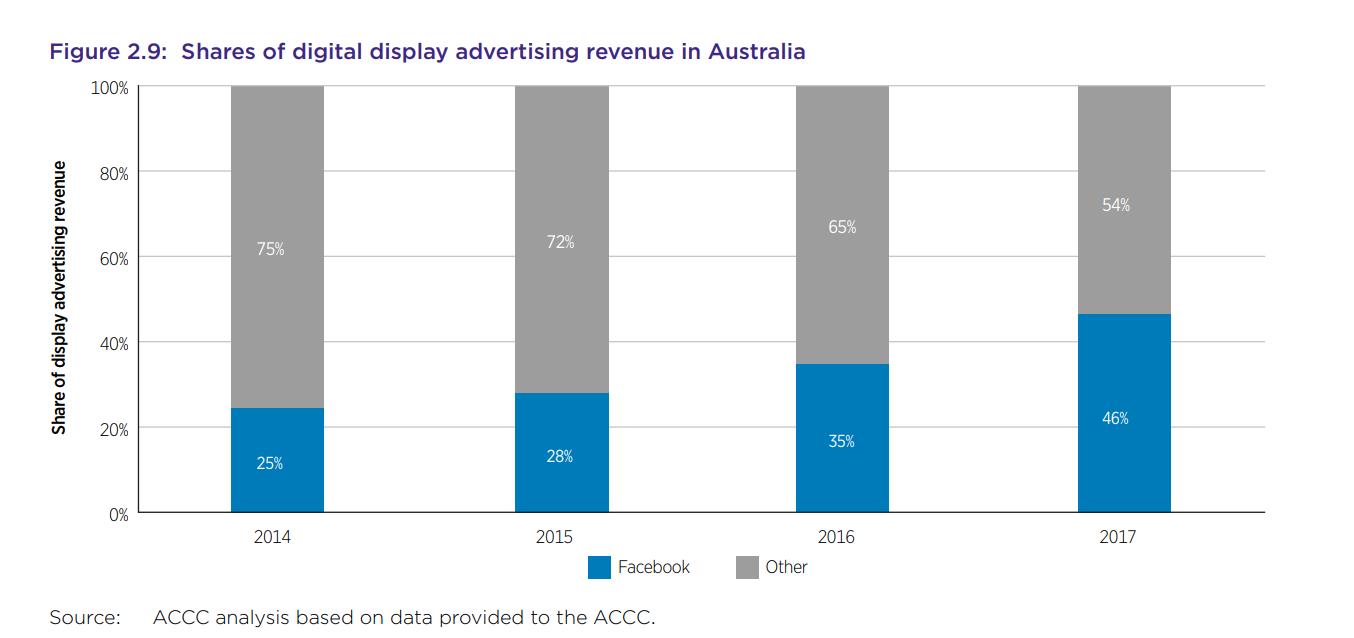

- Facebook has a unique audience more than three times that of Snapchat, which the ACCC describes as its ‘closest competitor’, and a 46% share of digital display advertising with no other provider having more than 5%.

Australian law does not prohibit a firm from having market power. However, in this instance the ACCC has formed the view that the market power of Google and Facebook needs to be managed, which is the basis for the ACCC’s key recommendations in the report.

Privacy concerns

In addition to its findings on market power, the ACCC recognises that in today’s digital economy, where ‘data is king’, increasing consumer privacy concerns about how personal information and other forms of data are being collected and used by digital platforms are related to issues of a lack of informed and genuine consumer choice. The ACCC considers that complex and opaque online terms and privacy policies have contributed to the amassing of valuable data by digital platforms and, in turn, the growth in their market power. To this end, the ACCC has made preliminary recommendations specifically dealing with the Privacy Act 1988 (Cth) (Privacy Act), powers of the Office of the Australian Information Commissioner (OAIC) and privacy rights.

Recommendations

The report contains 11 preliminary recommendations:

- 3 measures to directly address Google and Facebook’s market power:

- a reform to the merger law, which would apply to all mergers assessed by the ACCC, more explicitly allowing the ACCC to consider the likelihood that a transaction could remove a potential competitor and the amount and nature of data that may be acquired in a transaction.

- measures aimed at giving the ACCC early scrutiny of acquisitions undertaken by large digital platforms; and

- restrictions on the default settings for installation of internet browsers and search engines on computers, mobiles and tablet devices.

- 2 measures to give an unnamed “regulatory authority” increased power to scrutinise the digital platforms’ activities and their impact on news media organisations and advertisers. These measures would empower the regulatory authority to investigate complaints, initiate investigations and make referrals to other government agencies.

- A separate, independent and wholesale government review to design a new, platform-neutral regulatory framework for news media organisations and content classification.

- A Mandatory Standard regarding digital platforms’ take-down procedures for copyright infringing content.

- 4 measures to better inform consumers and improve their bargaining powers when dealing with digital platforms, although the proposed changes to the Privacy Act and ACL would apply to all businesses. These measures include:

- that the OAIC develop an enforceable code of practice under Part IIIB of the Privacy Act which would apply specifically to digital platforms;

- amendments to the Privacy Act aimed at enabling consumers to make more informed choices and exerting greater control over the distribution of their data. They include strengthening the notification and consent requirements under the Privacy Act, providing for an ‘erasure right’ where information is no longer needed, increasing the penalties for Privacy Act breaches to the same level as those related to breaches of the ACL and introducing a direct right of action for individuals whose privacy has been breached under the Privacy Act;

- support for the Australian Law Reform Commission’s call for the introduction of a statutory cause of action for serious invasions of privacy; and

- amendments to the ACL to render unfair contract terms illegal and subject to pecuniary penalty proceedings.

In addition to these preliminary recommendations, the ACCC has proposed eight areas for further analysis (including labelling regimes to increase transparency in news reporting and options to fund journalism in an era of declining advertising revenue) in the next phase of the inquiry.

The ACCC has also flagged that it is actively investigating five allegations that digital platforms have breached the Act, including four instances where actions relating to privacy policies may have breached the ACL.

What next?

While some recommendations are targeted specifically at digital platforms, the ACCC’s proposed legislative and regulatory reforms would be far-reaching and will directly impact a wide range of Australian businesses particularly in relation to mergers and acquisitions, privacy and consumer protection. That said, it is not clear whether the ACCC will choose a more targeted list of recommendations for the final report, considering that some of the recommendations in the preliminary report would require changes to the law that would be very difficult to implement in the short term.

The extent of the reforms proposed in relation to privacy are surprising but the approach taken by the ACCC is understandable. Many will see the proposed amendments to the Privacy Act as long overdue and the other proposed reforms as providing some much needed teeth to the OAIC’s enforcement mechanisms in this age of big data. It will be interesting to see how the renewed call for more direct rights for consumers to protect their privacy, including through a statutory cause of action for serious invasions of privacy, will play out in the final report and if this attempt will be successful – it is perhaps the strongest one yet.

The report also demonstrates the ACCC’s willingness to push for new and expansive regulation to curb the activities of companies that it considers have market power. The ACCC, as has been its approach in past inquiries, has assumed that it has the policy mandate to recommend far-reaching new regulatory functions. The ACCC does not engage with the question of whether Australia’s existing ‘backstop’ regulatory regime is an appropriate tool, or whether the digital platforms would meet the important threshold requirements for that regime to apply.

The ACCC Chairman, Rod Sims, recently disavowed the broader goals of competition law espoused by the “Hipster Antitrust” movement, affirming that the primary purpose of competition law in Australia will continue to be the promotion of consumer welfare, in accordance with the consumer welfare standard. However, the preliminary report shows the ACCC willingness to engage with broad public interest considerations (including privacy and the role of news and journalism in democracy) in addition to its core role of competition law enforcement and regulation.

The ACCC also notes its intention to engage with international bodies (such as the OECD, the ICN and ICPEN) and other competition regulators globally to discuss and share findings and recommendations. We should expect further cross-fertilisation of ideas on digital platform regulation.

The ACCC is accepting written submissions in response to the preliminary report until 15 February 2019. There are significant issues to be debated as part of the preliminary report so we will be publishing further insights focused on particular proposals and their likely impact.

The final report to the Treasurer is expected on 3 June 2019.

Visit SmartCounsel