Last week, the ATO released draft Practical Compliance Guideline PCG 2017/D4 (Guidelines), which apply from 1 July 2017 to new and existing cross-border financing arrangements between related parties. The Guidelines allow taxpayers to self-assess the risk level of their financing arrangements to determine the likelihood of an ATO review.

As part of the Guidelines, the ATO has offered a limited-period amnesty for taxpayers looking to de-risk their financing arrangements without penalties and interest.

Revisit your related party financing arrangements

Taxpayers should use the new Guidelines as a prompt to revisit their related party cross-border financing arrangements. Should a taxpayer transition their financing arrangements so that they fall within the ‘green zone’ (further described below), the Commissioner will exercise his discretion to remit penalties and shortfall interest charges.

To be eligible, taxpayers are required to make a voluntary disclosure to the ATO and adjust the terms of their financing arrangements so that they fall within the green zone. This concession is to remain in place until at least 16 November 2018. Importantly, this concession is not available for taxpayers that utilise carry forward tax losses at the time they make their voluntary disclosure.

We expect that this will be of interest to taxpayers who are reviewing their cross-border financing arrangements in the wake of Chevron and who are seeking lower-risk financing arrangements. However, given the stringent nature of arrangements in the ‘green zone’, take up of the amnesty may be limited in practice.

What are the ‘risk zones’?

The Guidelines set out the ‘risk zones’ that the ATO will use to assess risk. High risk financing arrangements will attract greater ATO scrutiny.

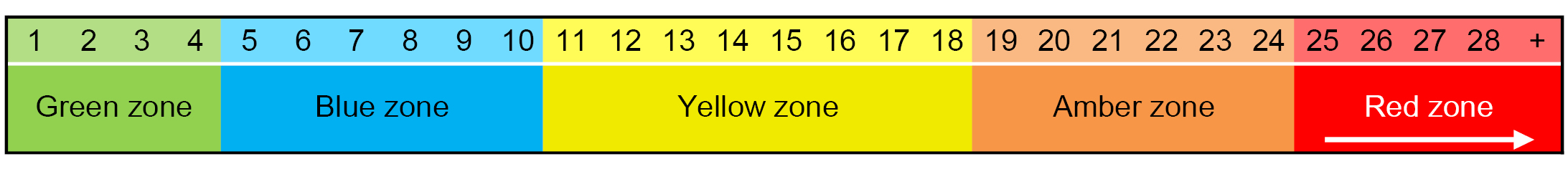

The ATO’s related party financing arrangement risk framework is made up of six risk zones, ranging from the white zone (arrangements already reviewed by the ATO) and green zone (low risk), through to the red zone (very high risk). Taxpayers in the red zone are likely to be subject to ATO review as a matter of priority.

At a high level, the Guidelines provide that the following factors contribute to the risk of a financing arrangement:

|

Factor |

Points |

|

The debt is not priced consistently with the global group’s cost of debt |

1 – 15 points |

|

The currency of the debt is different to the currency in which the borrower earns the majority of its revenue |

10 points |

|

The financing arrangement is covered by a taxpayer alert |

10 points |

|

At least one party is a hybrid entity |

10 – 15 points |

|

Inbound loans only |

|

|

Appropriate security (including guarantees and covenants) has not been provided |

3 points |

|

The financing arrangement has exotic features (e.g. convertible to equity, contingencies, payment-in-kind) |

10 points |

|

The financing arrangement involves subordinated or mezzanine debt |

3 points |

|

The headline tax rate of the lender’s jurisdiction is lower than Australia’s |

1 – 15 points |

|

The borrower’s interest coverage ratio is lower than Australia’s |

1 – 10 points |

|

The borrower’s leverage is higher than the global group’s |

1 – 10 points |

|

Outbound loans only |

|

|

The borrower’s jurisdiction has high sovereign risk |

1 – 10 points |

Taxpayers should consider the above factors to indicatively assess risk, and complete a more detailed analysis with their tax advisor.

Other comments by the ATO

In speaking at a Tax Institute conference on Friday 19 May 2017, Jeremy Hirschhorn (Deputy Commissioner) mentioned the ATO’s desire to see ‘vanilla arrangements’ that make sense on a commercial basis. Mr Hirschhorn stressed that guarantee fees cannot be used in lieu of higher related-party interest rates as the ATO will be taking a ‘whole cost of finance’ approach in considering related-party arrangements.

Mr Hirschhorn also discussed the difficulty for taxpayers in discharging their onus of proof in a related party context. In describing the Chevron decision, he stated that taxpayers cannot get an expert in “unicorns” (ie. mythical arrangements that don’t exist in real-world commerce) to justify the commerciality of uncommercial arrangements. He said that you can get an expert in horses, or other animals, but never unicorns, symbolising that it will be very difficult to discharge your onus of proof when trying to establish a unicorn.

Closing remarks

The Guidelines provide taxpayers with a useful look into what the ATO considers to be risky in the context of cross-border financing arrangements. This is particularly helpful given the recent handing down of Chevron.

Taxpayers who are concerned that their existing arrangements are not compliant are likely to be attracted to the amnesty offered by the Commissioner, although the requirement to transition all arrangements to the green zone – the lowest risk zone – may limit the take up.

Taxpayers should start reviewing their financing arrangements as soon as possible to see which of the risk zones they fit within, and to determine whether any changes to their arrangements are necessary. Taxpayers should seriously consider whether they should take advantage of the Commissioner’s amnesty.

Visit SmartCounsel