An ahead market in the national electricity market (NEM) is a step closer, with the Australian Energy Market Commission (AEMC) recently publishing a consultation paper on the implementation of a short term forward market (STFM) to operate alongside the NEM.

The consultation paper sets out several potential outcomes of the STFM that will assist in maintaining system reliability, including the facilitation of demand response in the NEM.

Although the consultation paper refers to the potential for the STFM to create stronger investment signals for investors, it does not elaborate on how that might occur.

While we agree that the STFM may help system reliability, it is not yet clear if it will “move the needle” and give stakeholders the strong investment signals that the market needs. Limited stakeholder support for a day-ahead market when the AEMC considered the issue as part of its 2018 Reliability Frameworks Review (following recommendations from the Finkel Review) seems to support this view, and we await with interest stakeholder responses to the more detailed STFM proposal.

In the short term – in particular in the lead up to and aftermath of the upcoming federal election – we expect that the focus of the reliability debate will be on competing Government and ALP policies (including the Retailer Reliability Obligation and the Underwriting New Generation Investments program).

In the longer term, and as the market continues to evolve, we would like to see that all options for enhancing reliability remain on the table and part of the debate – for example the possible introduction of some kind of capacity payment mechanism.

Background to the implementation of the STFM

The AEMC consultation follows the receipt by the AEMC on 20 December 2018 of a rule change request from the Australian Energy Market Operator (AEMO) to amend the National Electricity Rules to introduce an exchange for short-term forward contracts. This request was in turn based on an AEMC recommendation in July 2018 as part of the Reliability Framework Review, with that recommendation arising from recommendations in the June 2017 Finkel Review (for assessment of the suitability of a day-ahead market to assist in maintaining system reliability, as well as a mechanism that facilitates demand response in the NEM).

Key features

The proposed STFM would be operated by AEMO and allow buyers and sellers to voluntarily and anonymously trade standardised short-term electricity contracts daily on a rolling basis for a day ahead of the trading day and up to seven days in advance (D+1 to D+8). Contract specifications would be developed with industry with the potential for contracts over daily, hourly, peak or shoulder block contract durations.

Bids and offers would be matched continuously based on price and linked to each regional reference price in $/MWh. The platform for trading would be the Trayport platform used by AEMO to operate the Gas Supply Hubs and Capacity Trading Platform.

The STFM shares features with ahead markets (generally day-ahead markets) in many jurisdictions globally, including most European and North American markets.

Potential benefits

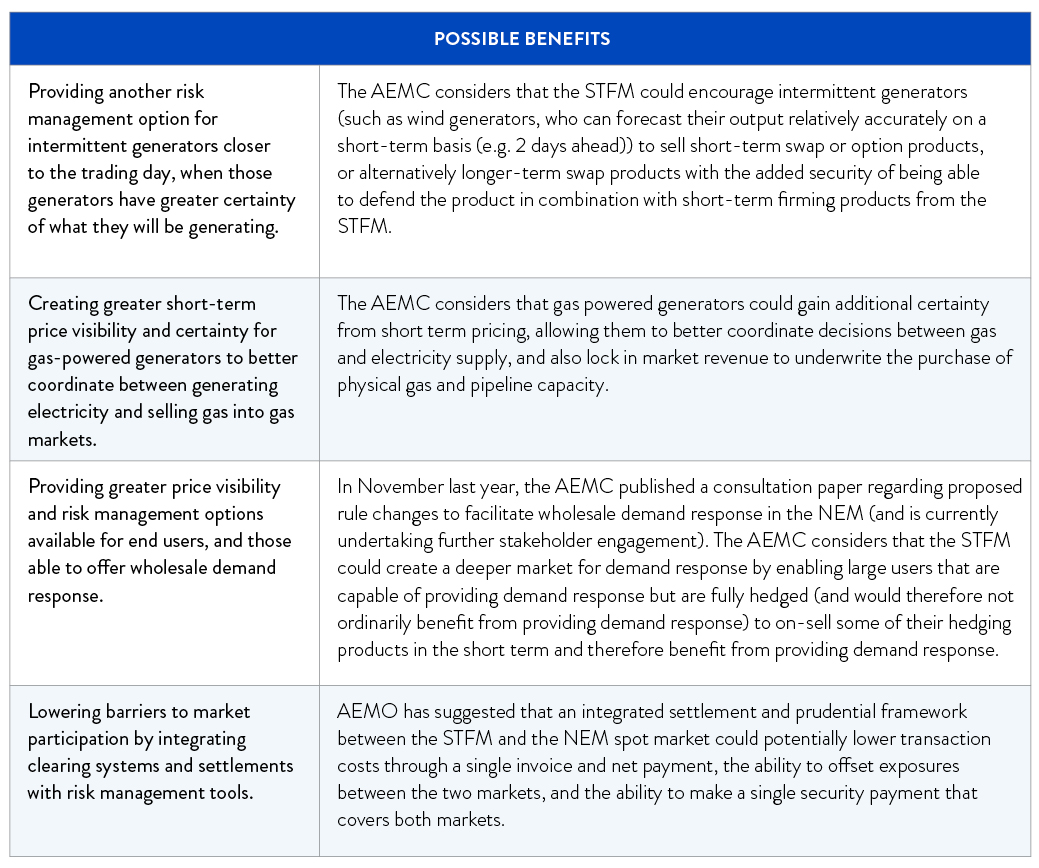

The consultation paper outlines a number of benefits that the AEMC and AEMO consider may arise from the STFM:

Creating stronger investment signals for investors?

While the STFM could be a useful tool to allow existing renewable generators and peaking gas fired generators that are not fully hedged to better manage the risk of short-term extreme price events, we wonder whether it creates the strong investment signal that is needed to encourage new projects and market entrants.

Ultimately, financiers to large-scale projects will still require projects to be underwritten by long-term offtake agreements for a significant portion of generation, and are in our view unlikely to attribute significant value to any enhanced ability to manage short-term risks in respect of uncontracted generation.

Further, trading in derivatives such as swap and option products will raise Australian Financial Services Licence considerations and require expertise outside of the core capabilities of many generators. We expect that some will consider that the level of investment required to participate in the STFM outweighs the potential benefits.

Stakeholder views on a possible day-ahead market sought during consultation relating to the AEMC’s Reliability Framework Review (which was published in July 2018 and considered a number of the Finkel Review’s recommendations) support this position, indicating that there is limited investor support for a day-ahead market, and that the deficiencies in the NEM that a day-ahead market might ameliorate have not been sufficiently identified.

Current industry focus

The STFM is an example of the Finkel Review’s preference for recommendations that build on the existing regulatory framework rather than fundamental changes to the market structure. While all consultation around better reliability in the NEM should be welcomed, and we consider that enhanced demand side participation in the NEM in particular has the potential to improve reliability, we were not surprised by the initial lukewarm response by stakeholders given the uncertain nature of the potential benefits of a day-ahead market.

As the energy market continues to evolve, and policy and the regulatory framework remain in a state of uncertainty, stakeholders continue to seek firmer investment signals and more substantive policy and regulatory changes to address reliability concerns. We expect that, in the short-term (and particularly in the lead up to and aftermath of the federal election), the debate will continue to focus on competing Government and ALP policies, including:

- the Retailer Reliability Obligation (requiring companies to hold contracts or invest directly in dispatchable energy to meet demand), which was first proposed as part of the Government’s now abandoned National Energy Guarantee and is in the process of being implemented by the Australian Energy Regulator (AER). The ALP has indicated that it is supportive of the Retailer Reliability Obligation, accompanied by an increased emissions reduction target of 45% by 2030; and

- the Underwriting New Generation Investments program (which will provide financial support to firm generation capacity), which is based on a recommendation by the ACCC in its June 2018 inquiry into retail electricity pricing and is in the process of being established by the Government. The ALP has repeatedly expressed concern that the program will be used to underwrite coal-fired power, which it opposes.

In the longer term, and as the market continues to evolve, we would like to see that all options for enhancing reliability remain on the table and part of the debate – for example the possible introduction of some kind of capacity payment mechanism. While the Finkel Review recommended against the introduction of a capacity market – noting the cost and difficulty of implementation – those costs, and the costs of other substantive structural changes to the NEM, may come to be outweighed by benefits over time as intermittent renewables account for more of our generation mix.

The AEMC has invited stakeholders to provide written submissions on the STFM consultation paper by 23 May 2019. We will continue to monitor the reliability debate and update readers on new developments as they occur.

Visit SmartCounsel