Welcome to our ACCC “conference week” edition of the energy regulatory update.

Fittingly, perhaps, it has been a month when Rod Sims strode into the energy policy debate with calls for asset base write downs, increased government subsidies and the re-regulation of retail standing offers. For those who have been living under a rock or outside broadband coverage, our summary of the ACCC’s controversial Retail Electricity Pricing Inquiry final report (released last week) is here.

The other leading development was publication by AEMO of its inaugural Integrated System Plan – available here. It represented a comprehensive technical report on the state of the NEM, which was (perhaps predictably, but unfortunately) quickly translated into a politicised debate about the future of coal generation.

In other developments this month:

- Submissions in response to the NEG detailed design were published – with approximately 150 submissions received.

- The COAG Gas Market Reform Group approved the final package of reforms for introducing mandatory capacity trading for pipelines. The information paper, published on 3 July, sets out the key elements of the reforms, which have been in development since AEMC recommended the framework as part of its Framework Review in 2016. The challenging task of implementation now begins in earnest for Australian pipeliners.

- In big news for regulated distribution and transmission networks – COAG approved a binding rate of return instrument followed promptly by the AER publishing its draft rate of return guideline. The AER has tightened the screws on regulated entities under its draft decision with lower values for MRP (6%) and equity beta (0.6). Gamma has been locked in at 0.5, although the AER has proposed more flexibility in the averaging period for the risk free rate (up to 60 business days, rather than the standard 20 business days). Other factors, such as benchmark credit rating and term of benchmark debt are unchanged from earlier guidelines. The AER has also appointed an independent panel to provide it with advice on the draft guidelines.

- Both the ACCC and AER have been busier than usual with a range of enforcement matters – both for misleading conduct and failures to comply with NECF requirements.

- The AER published its first set of compliance reports by Victorian DNSPs under the AER Ringfencing Guideline. In a related development that will also have an impact on ring fencing, the AER published its draft Service Classification Guideline setting out its proposed approach to classification of distribution services under the NER.

- The AEMC announced that it will be publishing a “directions paper” in August on changes required to the regulatory framework to better align and coordinate generation and transmission investment. Together with the AER’s review of the regulatory investment tests, this is definitely one to watch.

- Other notable AEMC rule changes or processes include:

- the AEMC finalised the rule giving AER responsibility for determining the value of customer reliability (which reflects criticism from the ACCC and others that regulatory reliability requirements have been too high in the past, leading to “gold plating” by networks);

- a draft rule has been introduced to establish a national battery register;

- the final package of AEMC recommended changes to pipeline regulation for covered pipelines was released, which (consistent with the draft report) provides for substantial extension of the services regulated and information requirements and which operates alongside expansion of regulation of non-scheme pipelines and capacity trading; and

- new Chapter 5 of the NER commenced this month, which introduces significant changes to transmission connection arrangements (proposed by COAG Energy Council) aimed at increasing transparency and contestability for connection services.

- the AEMC finalised the rule giving AER responsibility for determining the value of customer reliability (which reflects criticism from the ACCC and others that regulatory reliability requirements have been too high in the past, leading to “gold plating” by networks);

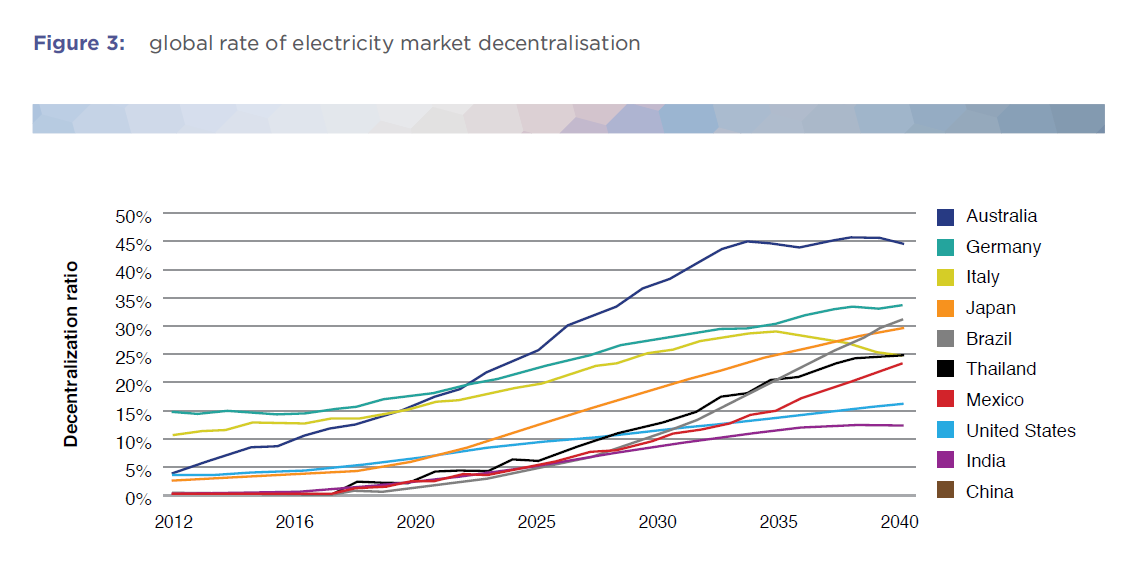

Finally, for those who didn’t see it earlier this week, AEMO and the ENA released an useful thought piece on the transition to an intelligent “two way” grid that facilitates a high penetration of distributed resources. While reasonably high level, the report maps the issues well. The paper is available here and I was particularly grabbed by this forecast, which tells you all you need to know about why getting DER policy settings right is critical for the Australian energy market over the next decade:

Download our latest update

Visit Smart Counsel