MIT in partnership with Infosys Cobalt has released the Global Cloud System Index 2022 (Global Cloud Index). It makes the opening point that strength in cloud computing is core to a country’s future economic success:

‘A decade or so ago, cloud computing was a burgeoning phenomenon, driving cost savings, flexibility, and innovation. Today, cloud is computing—a foundational resource for businesses and governments alike as they strive to harness emerging technologies such as 5G, artificial intelligence, and the internet of things.’

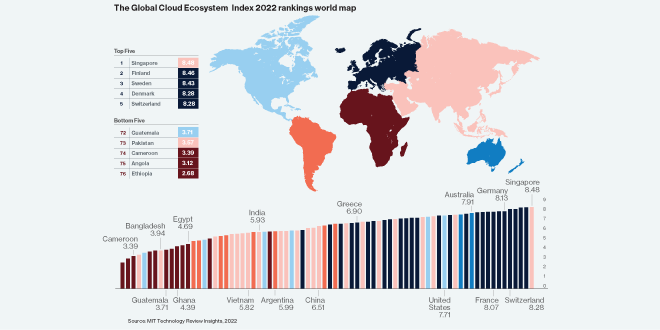

Singapore tops the ranking, followed by the ‘usual suspects’ such as Finland, Sweden, Denmark, Germany and Iceland.

Australia ranks 12 overall, ahead of New Zealand (14), Japan (15) and USA (17).

However, lying behind Australia’s overall ranking (which itself is not that stellar) are its much lower rankings in key areas, such as broadband speed, prices and human talent.

How the Index was compiled

The Global Cloud Index assessed 76 countries’ performance across 4 ‘pillars’:

- Infrastructure: how well each country is served by telecommunications networks and computing resources that enable cloud-centric production models, including the number of data centres, secure servers, and unique internet protocol addresses in each country, relative to its population. This pillar accounts for 15% of each country’s overall score.

- Ecosystem adoption: the extent to which each country’s businesses and citizens access the outputs of cloud application and services across public and private sectors. This includes measures of digital service adoption, participation in online services in the public sector, the growth in SaaS revenues, innovation, and the price of broadband services relative to gross domestic product. At 35%, this pillar contributes the largest portion to the Index’s score.

- Security and assurance: the maturity of regulatory environments that promote progressive, cloud-forward data security and sovereignty environments—and that enable trust in digital resources. This pillar has a weighting of 25% of the Index’s score.

- Talent and human affinity: each country’s human capital assets that can contribute to a cloud-based digital economy, including human capital productivity, depth of engineering and math skills, as well as the overall internet literacy in the society. This pillar accounts for 25% of a country’s overall Index score.

The Global Cloud Index is a ‘survey of surveys’ in that it aggregates a range of separate surveys, such as by the UN and the World Bank. It carries whatever flaws those underlying studies have (as well as the inherent challenges of global comparisons), but it still provides some useful insights into where Australia may need to lift its game.

What makes for success as a high performing cloud computing economy?

The Global Cloud Index had two important conclusions about the drivers of a country’s success in cloud computing readiness.

First, the same set of countries tended to top each of the 4 pillars, showing a ‘virtuous circle’ effect across the pillars. For example, half of the top 10 countries in the talent pillar are also in the top ranks of both the infrastructure and ecosystem adoption pillars, suggesting that the availability and capabilities of cloud talent are highly correlated with a market’s density of digital infrastructure and service adoption.

This is illustrated by comments from Tracey Arnish, vice president of human resources for Google Cloud’s platform engineering and technical infrastructure: “We select our cloud region locations based on customer demand to make services easier and faster for companies, and we also invest in those locations to make sure we have the right talent to serve our customers.”

There are a couple of notable exceptions. Japan which only ranks 17th overall, outperforms in cloud adoption at 6th place. This variance largely has to do with the huge success of Japan’s e-commerce marketplace, estimated to be $217 billion in 2021, which is the world’s third largest, and more than half of its households routinely shop online.

Conversely, Germany is ranked 6th overall, but only 24th in cloud adoption – for reasons which are almost the opposite story to Japan. Germany’s e-commerce market is relatively smaller than in other comparable markets, and most of the focus of cloud computing policy has been on a deeper transformation in its manufacturing and logistics sectors as it builds its fourth industrial revolution infrastructure and capabilities.

Second, success is driven by a tight level of co-operation between private and public sectors on cloud computing:

‘Global Cloud Ecosystem Index 2022 leaders combine digital infrastructure and governance leadership. Top scorers show significant efforts to propagate digital infrastructure and have digitally minded governments that use the cloud to deliver public services and safeguard personal data and digital transactions.’

Singapore was the standout, ‘thanks to a relentless “cloud-first” strategy.’

As discussed below, Australia’s report card is marked by the variability in its performance across the pillars.

Pillar 1: infrastructure

The Global Cloud Index makes the obvious point that the top ranked countries rely on ‘copious and reliable broadband’. The Index notes that improved in-country infrastructure is also driving decentralisation decisions by the global hyperscalers:

‘There has been a significant shift in the building of data centers globally over the last quarter century. As a result, data center builders and hyperscale cloud providers have shifted to hub-and-spoke distribution models, with remote computing resources connected to growing numbers of smaller edge computing facilities. The hub-and-spoke model also neatly dovetails with the growing need for nations to reduce energy-intensive infrastructure to achieve growing carbon emissions reduction targets.’

While Australia’s overall ranking on infrastructure is 12th, our ranking in internet speed is much lower, which some might find surprising given massive investment in the NBN:

Australia’s ranking on cloud infrastructure

However, there may be some good news for Australia not reflected in these figures. The Global Cloud Index notes the growing importance of 5G to cloud computing:

‘5G is going to play an important role in distributing compute and storage resources. This is because, cloud-forward policymakers hope, 5G networks will increasingly support multi-access edge computing (MEC) applications, automated systems, and managed networks of internet of things (IoT) and digital devices—all of which will allow enterprises and consumers to more effectively and productively access cloud computing resources.’

The Index gives South Korea as an example of how cloud computing can be driven by 5G. Australia is a global leader in the rollout of 5G networks and, while our speeds may lag behind South Korea, we are ahead of countries such as Singapore.

Pillar 2: ecosystem adoption

The Global Cloud Index considers that those companies that are doing well today are able to do so because the growing flexibility of cloud computing allows them to pick the right technologies to achieve their business outcomes. This has two ‘profound’ implications for the future state of the ecosystem:

- coordinated platforming of computing resources will drastically reduce ‘digital waste’: a collection of inefficient legacy infrastructure and an accumulation of unstructured data, much of it gathered through duplicated or siloed data-gathering processes.

- as adoption of open, API-based architectures grows, organizations will be able to share data, insights, and computing resources with their partners more efficiently and reciprocally. APIs will become the ‘mainstream’ and some Governments are promoting national API programs, such as the Australian Government’s API design standard.

Again, Australia’s performance on this pillar is marked by its variability:

Australia’s ranking on cloud ecosystem adoption

The competitiveness of NBN’s broadband pricing is currently being considered by the ACCC.

Pillar 3: Security

The Global Cloud Index notes that an overarching goal of most governments as they work to nurture their cloud-centric digital economies is to build and promote a “trust infrastructure”: the public policy and regulatory and social conventions that assure the digital channels used by an economy’s consumers and businesses are efficient, effective, and secure.

Australia gets a star turn here:

‘[An industry expert comments] that a speedy policy implementation must be complemented by a similar speed to review and revise cloud policies as circumstances change. She cites Australia, which had a ground-breaking cloud-first policy, revised every three or four years to incorporate new security policies. This included a cloud accreditation program designed to “create an ecosystem where vendors that serve the government were trusted,” but it was soon discovered that small and medium-sized Australian companies were left out of government procurement processes, as they struggled with the cost and complexity of the accreditation process. The Australian government responded quickly, reworking their program into a simpler, more inclusive online marketplace.’

But we perform relatively worse on data protection and privacy and press freedom:

Australia’s ranking on cloud security and assurance

Pillar 4: Talent

This is where – apart from broadband pricing and speeds – Australia performs the worst. On the general index of human capital – essentially the level of skills and education across our population - Australia comes out on top. But this does not translate into technology-specific skills.

Australia’s ranking on cloud talent resources

Market trends

The Global Cloud Index wraps up with a couple of interesting comments on market trends.

First, that well known IT risk of ‘cost overrun’, also bedevils investment in cloud computing by enterprises:

‘Increasingly cloud-dependent businesses are struggling to control spending: in its 2021 State of the Cloud report, Flexera noted survey results revealing that their average respondents went 24% over budget in public cloud spending and were anticipating cloud investment in the next year would increase 39%.’

Second, industry consolidation seems to be underway. Global cloud infrastructure spending in the fourth quarter of 2021 grew 34% year-on-year, to $53.5 billion, and that nearly two-thirds of that spend was captured by the world’s top three hyperscale providers.

Read more: The Global Cloud Ecosystem Index 2022

Visit Smart Counsel