On 30 June 2025, the government published the much-anticipated Competition and Consumer (Notification of Acquisitions) Determination 2025 that sets the filing fees and notification thresholds under the new merger control system.

The new notification regime is available voluntarily from 1 July 2025 and becomes compulsory on 1 January 2026.

Filing fees

Compared with the draft proposed fees, there has been some calibration of the Phase 2 filing fees based on the size of the transaction. However, the fees are still significant, reflecting the government’s ‘cost recovery’ principle for the new regime.

The new filing fees for 2025-2026 for notifying an acquisition under the new system are:

Category | Fee for 2025-2026 | |

Notification waiver application | $8,300 | |

Notification of proposed acquisition (Phase 1) | $56,800 | |

Additional fee for mergers that proceed to Phase 2

| If transaction value (being the greater of the market value or consideration receivables of all shares and assets being acquired) is:

This fee must be paid within 7 business days commencing from the day the ACCC advises the notifying party that the notification is subject to Phase 2 review. | |

Public benefits application | $401,000 | |

Tribunal review | Will be subject to separate government decisions and consultation. |

There is an exemption available for acquisitions made by small business entities as defined by the Income Tax Assessment Act 1997, that is where they carry on a business in the current year and the aggregated turnover for the previous year was less than $10 million, or the aggregated turnover for the current year is likely to be less than $10 million.

Notification thresholds

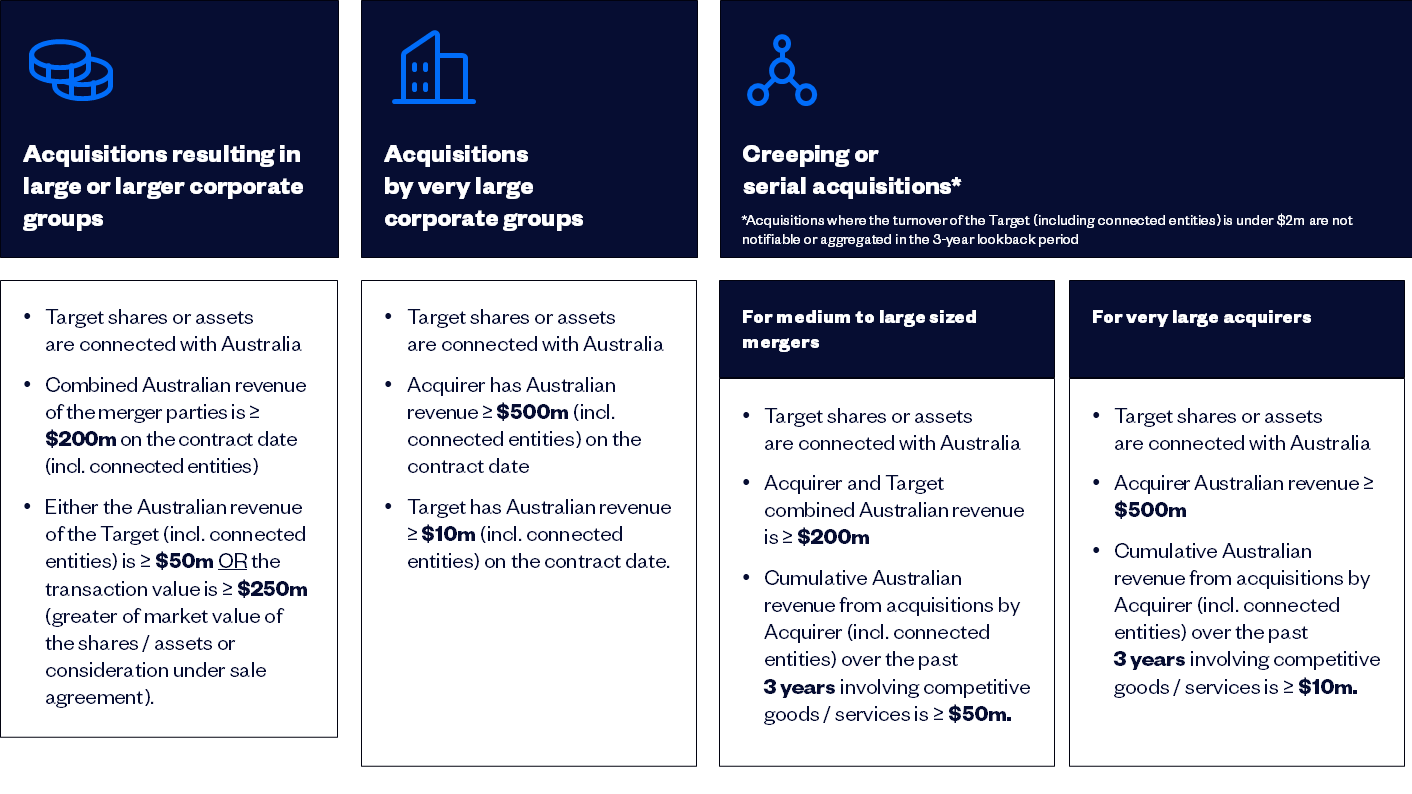

Parties will need to notify the ACCC of acquisitions if it involves shares or assets that are “connected with Australia” and the following tests are met (all figures shown in AUD):

The key concepts for the finalised notification thresholds are as follows:

Revenue calculated using accounting standards: ‘Australian revenue’ is defined as “an entity’s Australian revenue, at a time, is so much of the entity’s gross revenue, determined in accordance with accounting standards, for the entity’s most recently ended 12-month financial reporting period, that is attributable to transactions or assets within Australia, or transactions into Australia.” This replaces the previous concept of ‘annual GST turnover’ in the draft instrument. According to the Explanatory Statement, the intent behind this approach is to limit an entity’s gross revenue to what is attributable to transactions or assets within Australia or derived from sales to customers in Australia. However, gross revenue attributable to exports from Australia to customers in overseas jurisdictions is excluded from calculation.

‘Connected with Australia’ requires carrying on a business in Australia: A key criterion for determining if an acquisition of shares or assets is notifiable is that the target must be ‘connected with Australia.’ This is assessed by reference to whether the shares or assets of a business that ‘carries on business’ in Australia, or the asset is used (or forms part of) a business carried on in Australia. Significantly, the final instrument removes from the definition the broader concept of an ‘intention to carry on a business in Australia,’ which appeared in the draft. The Explanatory Statement refers to competition law cases where the courts have looked at all the circumstances surrounding the entity and its activities when determining whether it is carrying on a business in Australia.

‘Connected entity’: An entity is a ‘connected entity’ of another entity if the second entity is a related body corporate of the first entity, or if first entity controls the second entity, is controlled by the second entity, or both the first entity and second entity are controlled by another entity. The definition refers to ‘control’ within the meaning of section 50AA of the Corporations Act.

Clarifications to the revenue tests:

The accumulated acquired shares or assets revenue tests now requires both the current shares or assets and the previous shares or assets to relate (directly or indirectly) to the carrying on of a business that predominantly involves the supply or acquisition of substitutable/competitive goods or services (previously it only needed to merely involve such supply).

New special rule for multiple principal parties in very large corporate revenue test: If there is more than one principal party to an acquisition, then the very large corporate group revenue test is satisfied for the acquisition if it is satisfied for any one of the principal parties.

The small acquisition test now says where it is not reasonably practicable to attribute the Australian revenue of a target to an acquisition of an asset, the amount to be included is instead 20% of the market value of the asset.

New exceptions: In addition to exceptions for certain land acquisitions, acquisitions by an administrator, receiver, receiver and manager or liquidator, acquisitions which take place pursuant solely to a testamentary disposition, intestacy or a right of survivorship under a joint tenancy, and acquisitions related to certain fundraising activities from the notification requirement to avoid undue disruption to capital markets, there are now exceptions from notification for the following types of acquisitions:

Certain land acquisitions, including an acquisition of land for the purpose of developing residential premises or operating a land development or management business.

Financial market infrastructure, which includes acquisitions of a share or asset by operator of a clearing and settlement facility, and a participant in a clearing and settlement facility.

Acquisitions of a derivative or that results from a derivative, except where it results in the acquirer beginning (or can begin) to control if that entity did not have control previously, or where the acquisition results in the acquirer acquiring (or having the ability to acquire) substantively all assets of a business.

Acquisitions of a share or asset that is a debt instrument, a debt interest in an entity, part of an asset securitisation arrangement, part of a securities financing transaction, a security interest or that is directly connected with these types of shares or assets (other than in certain circumstances).

Acquisitions by a major supermarket of interests in land and acquisitions that do not relate to land on which a supermarket business is operating or will operate.

Next steps

We are now waiting for further detail from the government on the criteria and form for notification waivers.

The ACCC published its final merger assessment guidelines on 20 June 2025 and its interim merger process guidelines on 30 June 2025, setting out its analytical framework and process for assessing notified acquisitions while the new regime is available voluntarily now and when it becomes compulsory on 1 January 2026. We will publish an update setting out the key points and changes from the drafts shortly.

For our other reporting on the merger reforms, see here.