ASIC has introduced its new regulatory guidance on analyst sell-side research, after an extensive review and industry consultation process.

In R egulatory Guide 264 Sell-side research (RG 264) ASIC has tempered some of the more worrisome proposals from its draft guidance, although the introduction of more oversight and involvement by compliance teams will still create a burden for smaller research providers, and the guidance regarding interactions between research analysts and others interested in capital raisings is very prescriptive.

Some key takeaways from RG 264 are discussed below:

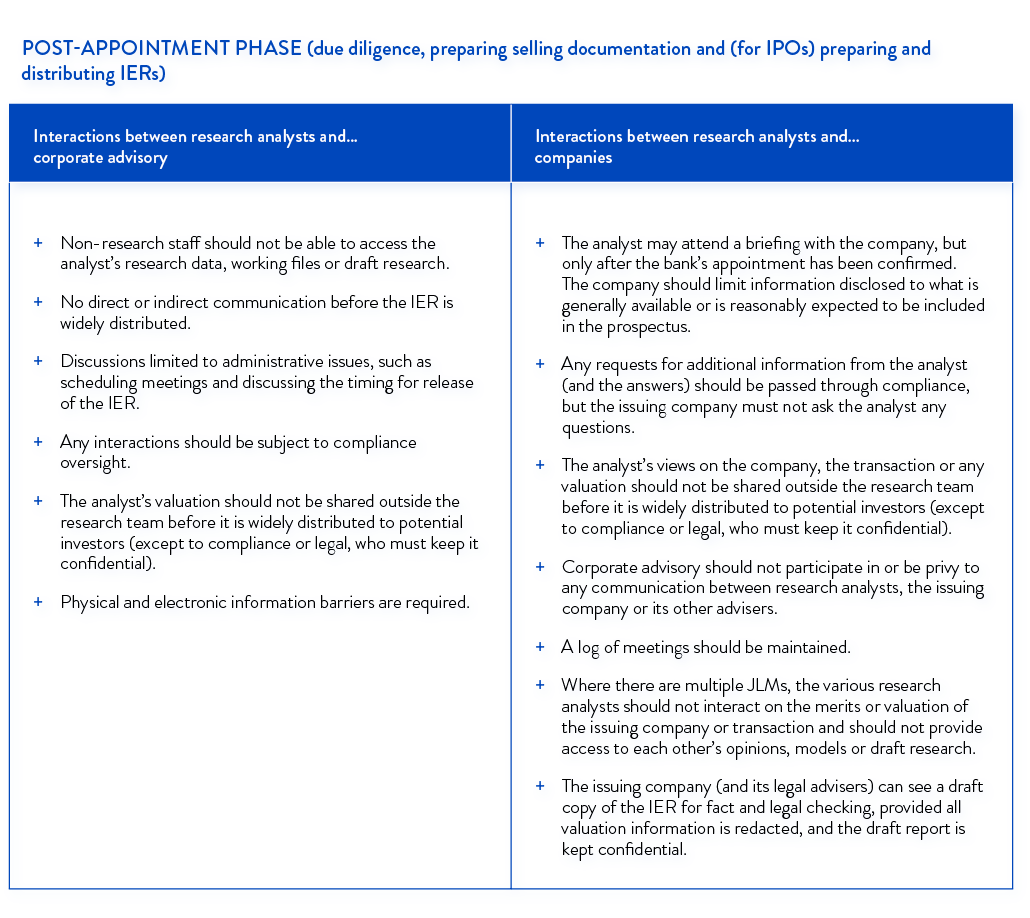

Despite objections raised during the public consultation process, RG 264 prevents disclosure in IERs of any company or valuation information, estimate or plans that will not be disclosed in the prospectus. This requirement will be practically challenging, as an analyst will not be in a position to know what information will be included in the final prospectus at the time his or her IER is published (although ASIC requires that any briefing to an analyst be restricted to information that is generally available or reasonably expected to be included in the prospectus). This will also mean that other valuation methods commonly used by research analysts but not included in prospectuses, including forecast future cash flows for discounted cash flow analysis and comparative business metrics, will be prohibited from IERs under the new RG 264.

RG 264 prohibits disclosure of the draft IER to corporate advisory staff prior to publication, despite the benefit that communication between research analysts and corporate advisory can have during the review of a draft IER in identifying fundamental errors (whether in the IER or the prospectus itself). During the fact-checking stage prior to publication, the draft IER can only be provided to the issuing company and its legal advisers (with valuation information redacted), reducing the input of any non-legal advisers in the process.

Despite objections raised during the public consultation process, RG 264 prevents disclosure in IERs of any company or valuation information, estimate or plans that will not be disclosed in the prospectus. This requirement will be practically challenging, as an analyst will not be in a position to know what information will be included in the final prospectus at the time his or her IER is published (although ASIC requires that any briefing to an analyst be restricted to information that is generally available or reasonably expected to be included in the prospectus). This will also mean that other valuation methods commonly used by research analysts but not included in prospectuses, including forecast future cash flows for discounted cash flow analysis and comparative business metrics, will be prohibited from IERs under the new RG 264.

RG 264 prohibits disclosure of the draft IER to corporate advisory staff prior to publication, despite the benefit that communication between research analysts and corporate advisory can have during the review of a draft IER in identifying fundamental errors (whether in the IER or the prospectus itself). During the fact-checking stage prior to publication, the draft IER can only be provided to the issuing company and its legal advisers (with valuation information redacted), reducing the input of any non-legal advisers in the process.

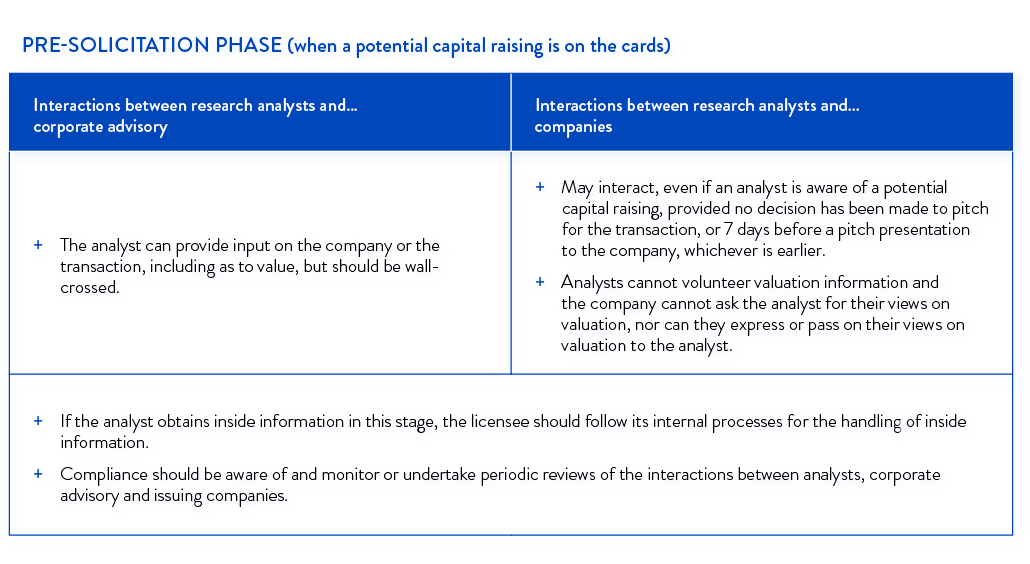

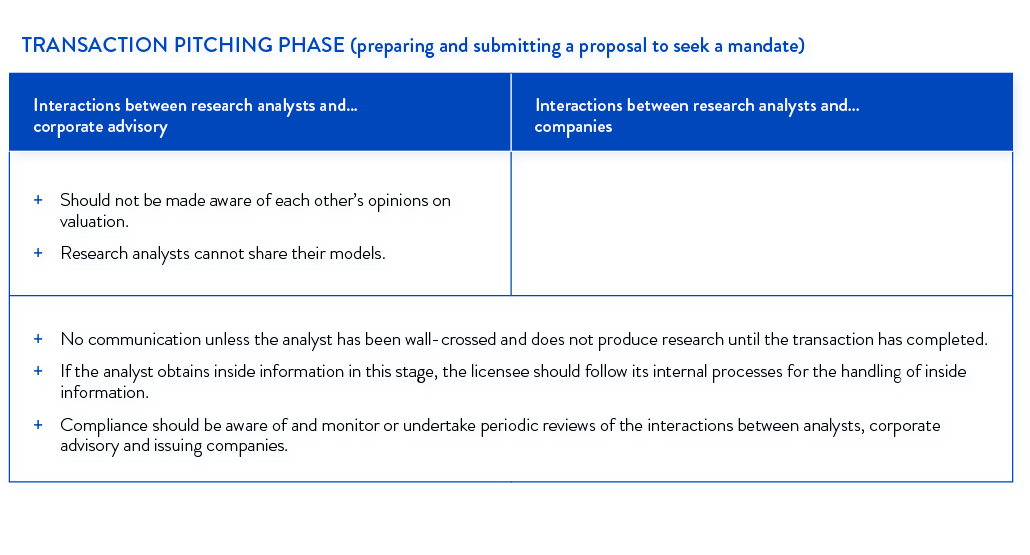

RG 264 provides detailed guidance for interactions between research analysts and companies (both listed and unlisted) at different stages throughout the capital raising life-cycle.

Finally, the new guidance contains some important positive departures from the draft guidance- here are our “Top 3”:

Research analyst declaration: Following negative industry feedback, RG 264 reduces some of the potential liability on the analyst in their personal capacity. Analysts are still required to certify that they are not in receipt of, and their report does not contain, inside information, but the certification will no longer be required to be published in the report, but will be for internal purposes only, and will be given to the best of the research analyst’s knowledge.

Replacement of IER: The new guidance allows for an IER to be amended if errors are identified or new information comes to light after the release of the IER which renders statements or information in it materially false, misleading or deceptive. The draft guidance did not permit any amendment, update or replacement of the IER once issued - only withdrawal of the report was permitted.

Disclosure of interests: The draft guidance proposed that research reports include disclosure of the number of shares and options held by the research analyst and the 5 largest share and option holders at the licensee. Whilst ASIC no longer requires this disclosure, RG 264 does require that research reports include disclosure of any material interest the licensee and its employees have in financial products the subject of the research, including details of the licensee’s beneficial interests in securities.

Industry participants will have until 1 July 2018 to confirm their compliance practices to the new guidance.