The recent release of the report on Western Australia’s Green Steel Opportunity (Report) prepared by the Mineral Research Institute of Western Australia has highlighted key pathways through which WA can join the green steelmaking value chain.

What is green steel ?

The term “green steel” refers to steel which is produced using renewable energy sources, as opposed to traditional steel which utilises fossil fuels throughout the process. However, the Report broadens the bounds of that definition to include not only 100% green steel, but also any opportunity to use lower carbon sources or renewables throughout any stage of the production chain of steelmaking.

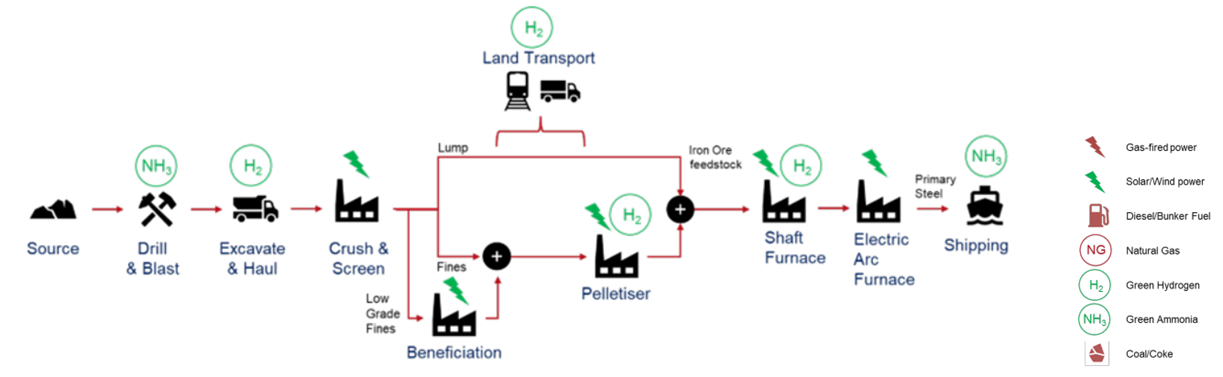

The below diagram from the Report depicts a fully decarbonised steel value chain where green ammonia, green hydrogen or green energy (wind or solar) is substituted into existing processes:

The Report focuses on the opportunities, challenges and potential for WA to support a green steel industry and create new markets for WA iron ore along different stages of the steel value chain.

WA’s unique opportunity: From iron ore to green steel

WA is uniquely placed as the largest source of iron ore in the world, accounting for 38% of the global supply, to become an active force in decarbonising the steelmaking industry. WA’s abundance of reserves, coupled with established infrastructure, political and regulatory stability and existing iron ore competitive advantages highlight the existing foundation which supports WA’s potential to meaningfully contribute to the decarbonisation of steelmaking.

However, critical success factors include WA’s ability to:

attract significant investment;

produce or purchase green hydrogen on a commercial scale at much lower cost;

become a leader in research, development and commercialisation of green steel; and

develop significant infrastructure to support a green steelmaking industry.

WA’s iron ore sector is the state’s largest industry and is a financial bolster to the state, accounting for 28% of the State Government’s revenue in 2020-21. Iron ore miners in WA have enjoyed an average gross margin on sales of iron ore of 61.1% over the last six years. However, steelmakers have on average seen a gross margin of around 13.6% over the past 20 years due to much greater initial capital outlays required. The economics of steelmaking is therefore a significant barrier to entry for both new and existing market participants.

Economic impact modelling

The Report details economic impact modelling conducted to demonstrate the size of WA’s green steel opportunity in terms of GDP, real income, taxes and employment from construction through to 2050, giving the projects a 24-year operational lifespan.

It outlines three different scenarios. The first two scenarios arise where WA develops the capacity to produce green iron in the form of hot briquetted iron (HBI), and then further where WA develops the capacity to produce green steel. The third scenario runs in the alternative, where there is a decline in WA’s iron ore sector.

The projections for scenarios one and two are summarised in the table below:

| Scenario | Impact on GDP | Impact on real income | Impact on C'th and State tax | Impact on employment |

|---|---|---|---|---|

| Scenario one - green iron in the form of HBI | $85 billion | $66.5 billion | $31.7 billion | 1,540 FTE jobs |

| Scenario two - green steel | $56.2 billion | $45.6 billion | $19.4 billion | 1,434 FTE jobs |

| Total increase | $141.2 billion | $112.1 billion | $51.1 billion | 2,974 FTE jobs |

While the benefits would largely be realised in the Pilbara region of WA, the Australian economy as a whole stands to significantly benefit from WA playing an active role in the green steelmaking value chain.

In the alternative, the Report projects the potential decline in WA’s iron ore sector, which would be felt most heavily by the Pilbara region in WA. The scenario is extreme but depicts a future where there is a significant reduction in demand for WA iron ore as a result of other global suppliers being in a better position to succeed in a “green steel world”. It demonstrates how critical it is that the Australian iron and steel industries take strides to become greener. The modelling projects that the decline in the Pilbara region’s economy could, by 2050, reduce:

GDP in Australia by $313.3 billion;

WA’s royalty income by $37.2 billion;

Commonwealth taxes by $169.5 billion on account of lower company tax; and

employment in the Pilbara region by 34,570 FTE.

The Report notes that the likelihood of the decline model coming to reality is very low but highlights the importance of ensuring that WA utilises its green steel opportunities to its fullest extent, to ensure that demand for the region’s iron and steel products continues.

Pathways to Green Steel

The Report identifies and analyses five pathways through which iron ore processes at various stages in the steel value chain can be adapted to produce green steel. The five pathways are:

green iron ore mining;

green pellets;

HBI from green pellets using fossil fuels;

HBI from green pellets using renewable hydrogen; and

domestic production of green steel, with full renewable energy solutions.

Below we set out a brief description of each of the pathways, their potential to reduce carbon emissions and their cost implications compared to current methods.

Iron can be extracted from two types of ores: hematite and magnetite. Hematite has traditionally been the dominant ore mined in Australia and contains an average iron content of between 56-62%. Magnetite mining is an emerging industry in Australia and contains an average iron content of between 30-35% iron, however through beneficiation, this becomes concentrated to around 65%. The pathways below therefore set out the cost implications in respect of the use of both hematite and magnetite.

Pathway 1 - Green iron ore mining

This pathway proposes that mining of hematite and magnetite concentrate be conducted using renewable energy sources. This would see new mines transition to renewable energy sources and existing mine infrastructure being replaced or modified to run on renewably sourced energy over time. This pathway is cost-competitive in the current economic climate due to the low cost and the effectiveness of renewable power sources.

Emissions would be reduced by 0.07 tCO2 per tonne of steel produced, with very little difference between the levelised cost of production for green iron ore as opposed to fossil fuel iron ore, being $2.87 more per tonne for hematite and just $0.68 more for magnetite.

Pathway 2 - Green pellets

This pathway proposes an opportunity for WA to produce a new product, green pellets, as an addition to the suite of iron ore exports it currently supplies to global markets. In this way, WA could contribute to the value chain beyond the initial mining stages.

Steelmaking technologies currently rely on iron ore stockfeed of large sizes to be fed directly into an ironmaking furnace. Where lump hematite is not of sufficient size, the finer ores must be agglomerated to make them suitable for use. This process could be decarbonised through the process of pelletisation through which a hydrogen indium furnace is used to form pellets as an intermediate product which is then exported to be used in subsequent stages of the steelmaking process. Green pellets are a necessary pathway to producing 100% green steel and present an opportunity for WA to reinforce its value in the market.

Emissions would be reduced by 0.12 tCO2 per tonne of steel produced, however hydrogen costs are a barrier at this stage. As a result, the difference between the levelised cost of production for green pellets as opposed to fossil fuel pellets is $32.96 more per tonne for hematite and $19.66 more per tonne for magnetite.

Pathway 3 - Iron making: HBI from green pellets using fossil fuels

This pathway considers using green pellets from natural gas along with the utilisation of current technology to produce HBI as opposed to using fossil fuels to make pig iron. HBI is a compacted form of iron which is typically used as feedstock to make steel in an electric arc furnace. The significant challenge for this pathway is that it will result in an increase in WA’s domestic emissions (almost a five-fold increase) but at a broader scale, it would result in a 56-59% net reduction in global steelmaking emissions.

The difference between the levelised cost of production using HBI produced from fossil fuel green pellets as opposed to fossil fuels in pig iron form significantly favours HBI developed from green pellets, costing $183.76 less per tonne for hematite and $189.62 per tonne less for magnetite.

Pathway 4 - Iron making: HBI from green pellets using renewable hydrogen

This Pathway is an alternate to Pathway 3 above and considers using HBI from green pellets using renewable hydrogen (as opposed to relying on natural gas). That is, this pathway considers producing HBI fully through the power of renewable hydrogen and renewable electricity. The most significant barrier to this pathway currently is the price of renewable hydrogen. Once the hydrogen price falls to around $4 per kilogram, this pathway will become economically competitive. In the meantime, Pathway 3, set out above, provides an opportunity to begin the transition to fully green HBI production.

The levelised cost of production from green iron using renewable hydrogen green pellets as opposed to fossil fuel green pellets demonstrates the current high cost of green hydrogen, costing $204.42 more per tonne for hematite and $198.55 per tonne for magnetite.

Pathway 5 - Green Steel: domestic production of green steel, with full renewable energy solutions

The final pathway proposes the production of green steel in WA using an electric arc furnace powered solely by renewable hydrogen and renewable electricity. In order for WA to produce green steel, green hydrogen costs and renewable electricity prices will need to fall. This will require substantial capital input and development of mass infrastructure.

The levelised cost of production for producing green steel as opposed to fossil fuel steel is greater, costing $287.09 per tonne more for hematite and $265.07 per tonne more for magnetite at current input prices and using current technology.

Impact of Government and policy initiatives

The Report highlights the critical role of infrastructure projects to support the development and production of value-adding green iron and steel products in WA. The Report notes that similar infrastructure challenges currently exist with large-scale renewable energy projects in WA, and that a common user infrastructure build program in the next few decades could be highly beneficial.

In alignment with Australia’s commitments under the Paris Agreement and the Safeguard Mechanism, strides are to be taken to reduce emissions and innovate greener technologies. There are a number of funding and regulatory initiatives at both the Federal and State level which have been developed to encourage and assist the development of green energy, green hydrogen and green steel projects.

WA has an opportunity to become a world leader in green iron and steelmaking value chains. The benefits for WA, Australia as a whole, and the global steelmaking industry could be significant, if WA can innovate to overcome the barriers which it currently faces.