Since our last enforcement wrap-up, the ACCC has kept busy on the consumer law front, issuing infringement notices, accepting court enforceable undertakings and instituting proceedings for more serious conduct.

In this bumper edition, we highlight some of the key ACCC actions and outcomes since the second half of 2023 including some fresh proceedings to keep on your radar for 2024. In particular:

Mazda has been ordered to pay a $11.5 million penalty for making false or misleading representations to nine consumers who experienced recurring and serious faults with their Mazda vehicles within two years of purchase;

Airbnb has been ordered to pay a $15 million penalty for misleading consumers about the currency of the prices it advertised on its platform, with another $15 million to be made available for consumer redress. Airbnb admitted that between January 2018 to August 2021, it misled consumers that the prices for accommodation in Australia were in Australian dollars when the prices were actually in US dollars;

Fitbit has admitted in proceedings before the Federal Court to making false, misleading or deceptive representations to 58 customers about their consumer guarantee rights to a replacement or refund of faulty Fitbit devices. This included telling customers that they did not have a right to a replacement product because Fitbit’s two-year ‘warranty period’ had expired;

Honda has been ordered to pay penalties totalling $6 million after admitting that it made misleading representations to customers about the closure of certain former authorised Honda dealerships around Australia, which had not in fact closed;

Australia Post and StarTrack will provide up to $2.9 million in compensation to its business contract customers and StarTrack delivery recipients in relation to lost or damaged goods. The postal group entered into an enforceable undertaking with the ACCC after admitting that it likely engaged in misleading or deceptive conduct in how it managed compensation requests;

the ACCC’s commenced actions against Emma Sleep , eHarmony EnergyAustralia and Express Online Training demonstrate the ACCC’s continued willingness to take businesses to court over misleading representations on their websites and social media platforms;

the ACCC has issued infringement notices or accepted court enforceable undertakings from several businesses, demonstrating its ongoing use of these enforcement tools to address suspected contraventions of the ACL - this was seen in the recent Crusader Caravans , Delicia Franchising Riff Raff , Pet Circle and Stellantis matters; and

the ACCC has accepted its first administrative outcome in relation to greenwashing conduct - a court enforceable undertaking - following an investigation into MOO’s “100% ocean plastic” representations.

We consider the key aspects of each of these cases in turn below.

The Federal Court drives the matter home - Mazda penalised $11.5 million for false and misleading representations about consumer guarantees

On 14 February 2024, the Federal Court ordered Mazda Australia Pty Ltd (Mazda) to pay $11.5 million in penalties for engaging in misleading or deceptive conduct and making false or misleading representations to nine consumers about their consumer guarantee rights.

Between 2013 and 2017, nine consumers experienced recurring and serious faults with their Mazda vehicles within two years of purchase. When these customers requested a refund or a replacement vehicle, Mazda represented that the only remedies available were a vehicle repair, a partial refund of the vehicle’s purchase price or a replacement vehicle (on the condition that the customer made a significant payment and had already attempted to repair the vehicle multiple times).

The ACCC instituted proceedings against Mazda in October 2019.

On 30 November 2021, the Federal Court handed down its liability decision finding that Mazda had made 49 false representations in contravention of sections 18 and 29(1)(m) of the Australian Consumer Law (ACL). The false representations were divided into two categories:

those concerning the existence or effect of the consumer guarantees; and

those concerning whether Mazda had reasonable grounds for forming the opinion that the consumer was not entitled to a refund or replacement vehicle at no extra cost.

The Court dismissed the ACCC’s claim that Mazda had also engaged in unconscionable conduct in contravention of section 21 of the ACL.

Mazda subsequently appealed the Court’s finding that Mazda made the 49 false or misleading representations to consumers, and the ACCC appealed the Court’s decision to dismiss the unconscionable conduct allegation. Both appeals were dismissed by the Full Federal Court on 23 March 2023, with the penalty sum being referred back down to the trial judge for determination.

In addition to the imposition of an $11.5 million penalty, the Court ordered Mazda to pay a total of $82,000 in compensation to some of the consumers, implement an ACL compliance program, publish a corrective notice on its website, notify dealers of the Court’s findings and pay a contribution to the ACCC’s costs. Mazda also separately undertook to pay a further $3,000 in compensation to each of the consumers whose vehicles were the subject of the proceeding.

(Mis)bed and Breakfast: Airbnb penalised $15 million for misleading consumers about the currency of accommodation bookings

On 20 December 2023, the Federal Court ordered Airbnb Ireland UC (Airbnb) to pay $15 million in penalties and to offer up to $15 million in compensation to affected customers, for misleading consumers about the currency of the prices on its accommodation platform.

Airbnb did not clearly disclose that prices for booking accommodation in Australia through its platform, using the “{{main}}rdquo; sign denomination, were for United States Dollars (USD) rather than Australian Dollars (AUD ) . The relevant conduct occurred between 1 January 2018 and 30 August 2021 affecting 63,000 customers, when there was a material difference in the AUD-USD exchange rate. The Court noted one example for 30 April 2018, where the exchange rate for 1 AUD was 0.7570 USD. The quantum of the currency differential was estimated to be approximately AUD $16.8 million.

Although Airbnb disclosed that the dollar amount was for USD at the bottom of each of the first three pages of the platform and on the final confirmation page for the booking, Airbnb accepted that “overall and viewed objectively”, the representation was contrary to sections 18 and 29(1)(i) of the ACL.

In addition to the above conduct, 2,088 users who booked accommodation in Australia raised complaints with Airbnb about being charged in USD. Some complainants were told that they had been charged in USD because that is what had been selected on the booking platform, however, this was not true.

The ACCC instituted proceedings against Airbnb on 8 June 2022, but Airbnb ultimately admitted to the conduct and reached an agreed position with the ACCC that was put to the Federal Court. Airbnb was also ordered to pay part of the ACCC’s costs, establish and maintain a consumer law program, and implement a consumer redress program. The consumer redress program is estimated to cost Airbnb a further $15 million in compensation to the approximately 63,000 affected customers.

There are two notable takeaways from the Airbnb case:

Representations must be clear, and consideration should be given as to whether the representation is likely to mislead or deceive when viewed in its full context. It is apparent that minor disclosures may not be considered sufficient to inform consumers about the intended representation being made.

There are material incentives for respondents to cooperate with the ACCC throughout the investigation and during any subsequent proceedings, and to proactively engage in consumer redress to reduce potential penalty amounts or adverse orders. In this context, his Honour observed that “Airbnb has not behaved as a recalcitrant in response to the ACCC investigation or this proceeding The result is a very significant saving in the resources of the ACCC, the costs of the proceeding and the resources of this Court. The early acknowledgement of misconduct by Airbnb has been commendable. I accept the submission put for Airbnb that these matters indicate a lower need for specific deterrence, particularly combined with the consumer redress undertaking and with it the scheme to refund affected consumers at an estimated cost of up to AUD15 million.”

Dude, where’s my dealership? Honda pays $6 million for misleading consumers about dealership closures

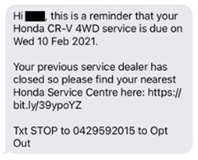

In December 2023, Moshinsky J handed down a $6 million penalty to Honda Australia Pty Ltd (Honda) for falsely representing that certain former Honda dealerships and service centres would or had closed and were no longer servicing Honda vehicles. Honda sent emails and text messages to 2,133 customers and had 17 call centre conversations with customers of the relevant dealerships - Astoria in Victoria, Tynan in New South Wales and Burswood in Western Australia (together, the Dealerships) - over a period of several months.

The conduct arose in the context of Honda conducting a restructure in early 2021 to transition its dealerships from a franchise model to an agency model. As part of the transition, Honda identified dealers that would be offered the opportunity to participate as agents under the new model and those dealers that would not be made such an offer, which included the Dealerships.

The ACCC instituted proceedings in April 2022 alleging that between January and June 2021, Honda contravened sections 18 and 29(1)(j) of the ACL by falsely representing that the Dealerships would close or had closed, and would no longer service, or were no longer servicing, Honda vehicles. This was not true because the Dealerships were not closing and continued to operate service centres for vehicles independently (including for Honda vehicles).

Honda admitted that it made the alleged representations through emails, text messages and call centre staff. Certain other communications about the closure of dealerships were contested between the ACCC and Honda, however, the Federal Court concluded that these additional statements did not contravene the ACL.

As with all ACL matters, it is essential that representations convey the true meaning of their underlying facts. In this case, the term “closing” or “closed” used in the communications made by Honda did not accurately reflect that the Dealerships had only ceased being authorised dealers. An example of the type of SMS communications made by Honda is shown below.

The Federal Court imposed a penalty of $5.5 million in respect of the email and SMS communications and $500,000 for the 17 call centre contraventions. The Court also ordered that Honda pay 90% of the ACCC’s costs of the proceeding.

A costly misstep: Fitbit fined $11 million for misleading consumers on consumer guarantees

On 12 December 2023, the Federal Court ordered Fitbit LLC (Fitbit) to pay $11 million in penalties after it admitted to making false, misleading or deceptive representations to 58 customers about their consumer guarantee rights to a replacement or refund of faulty Fitbit devices.

Fitbit admitted that it made representations to 40 customers between about November 2020 and February 2022 that they did not have a right to a replacement product as their Fitbit’s were outside of the 2-year warranty period.

Additionally, Fitbit admitted that it incorrectly told 18 consumers between about May 2020 and February 2022 that they did not have a right to a refund unless they returned their faulty device within 45 days of purchase.

This is not the first time Fitbit has run into trouble with the ACCC, with Fitbit (Australia) Pty Ltd (a related company of Fitbit) giving the ACCC a court-enforceable undertaking in May 2018 after it acknowledged that it made representations to consumers about warranties for faulty products that may have contravened the ACL.

Australia Post admits to not delivering for its business contract customers - ACCC accepts court enforceable undertaking

On 19 December 2023, Australia Post and its subsidiary StarTrack admitted that between 26 October 2018 and 31 October 2022, they likely engaged in misleading or deceptive conduct for failing to accept compensation requests and incorrectly advising some business customers that no compensation was payable to them for lost or damaged goods. The companies admitted that the relevant conduct is likely to have breached sections 18, 29(1)(m), 29(1)(n) and 34 of the ACL.

Under the section 87B court enforceable undertaking provided to the ACCC, Australia Post and StarTrack will compensate approximately 10,500 affected business contract customers and just under 1,000 recipients of StarTrack deliveries. The total compensation amount is estimated at $2.9 million.

The relevant conduct occurred following a change in the law which narrowed the scope of the transport exemption under section 63(1) of the ACL. Prior to 26 October 2018, section 63(1)(a) excluded the application of the consumer guarantees to any transport services where the transport of the goods was for the purpose of either the sender’s or receiver’s business. From 26 October 2018, a change in the law meant that consumer guarantees would continue to apply where the receiver is using the transported goods for a non-business purpose.

Australia Post Group has also committed to implementing rectification measures and establishing a compliance program, which includes staff training and informing the ACCC about the progress of the compensation program.

Sweet dreams turn into a nightmare for Emma Sleep after ACCC institutes proceedings

On 14 December 2023, the ACCC instituted proceedings in the Federal Court against Emma Sleep GmbH, and two of its subsidiaries, Bettzeit Southeast Asia Inc and Emma Sleep Pty Ltd (Emma Sleep AU) (all together, Emma Sleep) for allegedly making false and misleading representations in the advertising of its mattresses, bed frames, pillows and accessories.

Specifically, the ACCC claims that between 15 June 2020 to 27 March 2023, Emma Sleep advertised:

its products for sale on the Emma Sleep website and other platforms by presenting a price for the purchase of the product and a higher price that was displayed in “strikethrough”, or by representing sale prices as subject to a specific percentage or dollar discount amount (for example, “GET UP TO 55% OFF” and “Save as much as $3,531”). The ACCC alleges that Emma Sleep advertised nearly all of its products by reference to these savings or discount representations, but in fact, the products for sale were almost never sold or offered at the non-discounted price.

its prices as part of a limited sales campaign by placing countdown timers on its website or stating that the campaign was ending soon. However, the ACCC has asserted that the countdown timers used by Emma Sleep would reach zero and then reset or prices for products would be maintained after the sales campaign had finished.

The conduct is alleged to have been undertaken by Emma Sleep AU on its own behalf or at the direction of Emma Sleep GmbH and/or Bettzeit Southeast Asia Inc.

The ACCC has stated that “Emma Sleep enticed consumers to buy its products by misleading them about the discount or savings they would get, and by creating an artificial sense of urgency about the availability of its discounted pricing”. The ACCC is seeking declarations, injunctions, penalties, consumer redress, costs and other orders.

The cost of online dating - the ACCC commences proceedings against eHarmony for misleading representations

On 7 September 2023, the ACCC commenced proceedings in the Federal Court against eHarmony Inc., an online dating platform, for allegedly contravening the ACL by making misleading statements on its dating website about the pricing, renewal and duration of its memberships.

Specifically, the ACCC alleges that:

Free Dating Representation - the references on eHarmony’s website to ‘free’ dating represented to members that they could engage in ongoing communication with other people on its platform free of charge when that was not the case. eHarmony’s basic membership had limited functionality, only enabling members to view blurred, unrecognisable profile pictures, “like” members’ profiles, receive and send a single reply to one text message from a premium member, send one virtual smiley face symbol and use the ‘icebreaker’ feature. eHarmony did not prominently disclose or clearly indicate that consumers had to subscribe to a paid premium membership to access key features of the platform.

Minimum Price Representation and Single Price not specified - eHarmony failed to prominently disclose the minimum total price payable during the purchasing process. eHarmony advertised a minimum price payable per month for premium membership as ‘from $xx/month’ for a 6, 12 or 24-month period, but failed to disclose a mandatory additional fee (of $3 per month) that was applied if consumers wanted to pay for their membership on a monthly basis.

Automatic Renewal Conduct - when customers signed up to paid premium memberships, eHarmony gave consumers the false impression or understanding that the subscription period was only for an initial 6, 12 or 24 months. However, the subscription automatically renewed unless steps were taken by the consumer to turn off automatic renewal prior to the end of the period, and in some cases, the subscription price applicable after automatic renewal was a substantially higher price than the initial subscription. The ACCC alleges that eHarmony failed to prominently disclose the automatic renewal, instead displaying the terms in small font late in the purchase process and in the terms and conditions.

One Month Representation and Cancellation Representation - eHarmony’s website displayed statements to the effect that consumers could subscribe to a premium membership for one month or would have an opportunity to cancel their subscription after signing up. However, subscriptions were only available for periods of 6, 12 or 24 months, meaning it was not possible for a consumer to subscribe for a month, and cancellation was not effective until the next renewal date for the subscription.

The ACCC is seeking penalties, declarations, injunctions, consumer redress costs and other orders for the alleged breaches.

EnergyAustralia in hot water over allegedly misleading customers about their energy prices

On 22 September 2023, the ACCC commenced proceedings in the Federal Court against EnergyAustralia for allegedly breaching the Electricity Retail Code (the Code) and the ACL by failing to provide mandatory pricing information to customers.

The Code requires energy retailers to communicate price information to small customers in a simple and standardised way to allow easy comparison of plans across different energy companies.

Specifically, the Code requires energy retailers to provide consumers with:

an estimated ‘lowest possible price’, being the total amount a ‘representative customer’ would be charged for the supply of electricity in the relevant financial year at offered prices, assuming particular conditions for discounts are met; and

the percentage difference between their offered prices disregarding any conditional discounts (i.e., the unconditional price) compared to the reference price (being the per-customer annual price determined by the Australian Energy Regulator).

The ACCC alleges that between June and September 2022, EnergyAustralia breached the Code and made misleading representations in breach of the ACL by failing to state, or alternately failing to clearly and conspicuously state, the ‘lowest possible price’ and the percentage difference between their unconditional price and the reference price when sending price change notices to customers.

The ACCC is seeking pecuniary penalties, declarations, compliance orders, orders for a corrective notice and costs.

Another trainer requiring training on the ACL - Express Online Training in court for allegedly misleading students

On 24 November 2023, the ACCC commenced proceedings in the Federal Court against RSA Express Pty Ltd (trading as Express Online Training) for allegedly engaging in misleading conduct relating to their online responsible service of alcohol and construction induction training courses.

Express Online Training made statements on its website such as “Same Day Certificate”; “Only Pay After You Pass” or, “Best of all - with us you don’t have to pay until you pass!” , which the ACCC alleges falsely represented to potential participants that they would only pay, or be asked to pay, for online training courses after they had passed and that courses could be completed in one day. The ACCC allege that neither of these representations are true.

In reality, consumers had to schedule additional assessment tasks to obtain their certificates, which often could not be scheduled for the same day or even several days. According to the ACCC, these misrepresentations resulted in several consumers’ job prospects being jeopardised or lost as they were unable to complete the course and attain a certificate quickly.

The ACCC also alleged that Express Online Training’s use of the ‘pay when you pass’ statements and design of its website (which included prompting consumers to pay for the course before they had completed it) gave the misleading impression that consumers had completed the course and would receive their certificate when this was not the case.

The ACCC is seeking penalties, consumer redress, declarations, injunctions, costs and other orders.

Waterproofing representations not foolproof - Crusader Caravans issued with infringement notices

On 20 December 2023, CCMSM Manufacturing Pty Ltd (trading as Crusader Caravans) paid $33,000 after being issued with two infringement notices. The ACCC raised concerns with Crusader Caravans that it had made false and misleading representations under section 29(1)(a) of the ACL in relation to waterproofing tests conducted on the caravans that it manufactured.

The ACCC considers that between December 2022 and April 2023, Crusader Caravans made its 2023 Buyers Guide available to consumers which contained representations that it carried out tests on caravans to check for ‘waterproofing in storm-like conditions’. However, the tests were not designed to check for waterproofing, but rather to check for the lower standard of water resistance. The 2023 Buyers Guide was also emailed to around 40,000 consumers on 22 January 2023.

The caravan industry has been under particular scrutiny from the ACCC in recent years with the ACCC issuing a warning to caravan manufacturers and suppliers in October 2023 about existing obligations under the ACL, including prohibitions on making misleading representations. The ACCC had singled out consumer law issues in the caravan industry as one of its key Compliance and Enforcement Priorities for 2023-24 , and it will be interesting to see whether the ACCC maintains its focus on the industry in 2024-25 given its ongoing concerns. Watch this space.

Delicia Franchising gets a taste of a court enforceable undertaking

On 12 December 2023, South Australian-based Delicia Franchising Pty Ltd (Delicia) (operator of the “Delicia Acai + Protein Bar” franchise network) admitted that it breached the Franchising Code of Conduct (the Franchising Code) by not supplying sufficient details of Delicia’s annual marketing fund financial statements for financial years ending 2020, 2021 and 2022. For example, items such as 'advertising subscriptions' and 'online content' were given no explanatory information, such as the channels on which the advertising appeared or the percentage of the expenditure on a per-channel basis.

Delicia also failed to provide the statements to its franchisees within the required 30-day period under the Franchising Code and received an infringement notice of $11,100 for failing to provide a copy of the statement for the 2022 financial year specifically.

As part of the section 87B undertaking, Delicia is required to issue a corrective notice to its franchisees, as well as implement a training and compliance program regarding its obligations under the Franchising Code. ACCC Deputy Commissioner Mick Keogh commented that “[the] enforcement action should serve as a reminder to the franchise industry that preparing sufficiently detailed marketing fund statements and providing them to franchisees are key requirements of the Code”, and the ACCC will continue to conduct compliance checks and take enforcement action where necessary.

Keeping the Riff Raff accountable - Riff Raff issued $132,000 in infringement notices for false and misleading statements concerning product safety

On 29 November 2023, the ACCC announced that online national retailer, Riff Raff Baby Pty Ltd (Riff Raff) has paid penalties of $132,000 after the ACCC issued it with eight infringement notices for allegedly making false or misleading statements between February and March 2023 about its comforter toys being safe-for-sleep from birth.

Six infringement notices were issued in relation to safe-for-sleep representations made about six different toys on Riff Raff’s website, and one infringement notice each for representations made on Riff Raff’s Facebook and Instagram accounts.

Riff Raff advertised its sleep aid comforters for sale on its website and social media accounts, with frequent images of sleeping babies and prominent statements including “we always recommend the introduction of your Riff Raff Sleep Toy from birth where possible” , “Did you introduce your Riff Raff from birth? If you didn’t, do you wish you had?” and “designed with safety in mind.”

The ACCC was concerned that these ads conveyed the misleading representation that the sleep aid toys were safe to be used in unsupervised sleep environments with infants under seven months old. This is contrary to public health advice, which indicates that toys or other objects, particularly soft toys, should not be placed in a sleep environment with a baby less than seven months old.

In addition to the infringement notices, Riff Raff provided the ACCC with a court enforceable undertaking in which it admits that the advertisements for its sleep aid toys were likely to have breached the ACL. This undertaking contains a commitment by Riff Raff not to make these safe-to-sleep representations again, to amend its website and social media advertising to remove the representations, to provide corrective notices to all customers who purchased the products about the safety risks associated with the sleep aid toy products, and to establish a consumer law compliance program.

The ACCC has been focusing on consumer product safety issues for young children as part of its 2023-24 Compliance and Enforcement Priorities, including issues relating to infant sleep products.

Pet Circle unable to run circles around the ACL - Pet Circle pays $26,640 in infringement notices for false and misleading representations on the price of pet food

In August 2023, Millell Pty Ltd, trading as Pet Circle (Pet Circle), paid penalties of $26,640 after being issued with two infringement notices for allegedly making false and misleading representations on its website to two customers about the price of goods at checkout when completing a purchase of pet supplies.

The impacted customers used Pet Circle discount codes/vouchers of $15 and $20 respectively, which were applied at the point of sale. However, the total order price later displayed (accounting for the discount) was incorrect as the customers were later charged an additional amount equal to the discount.

In addition, from at least June 2019 to April 2023, Pet Circle advertised a range of products on its website with the statement “Don’t pay $X, save Y%”. The ACCC alleged that this statement represented to consumers that Pet Circle, or one of their competitors, had previously sold the product for the “Don’t pay” price when in reality and as admitted by Pet Circle, that was not the case and often the higher price was the Recommended Retail Price of the manufacturer.

The ACCC accepted a court enforceable undertaking from Pet Circle where it admitted that its conduct likely contravened the ACL. Pet Circle also agree not to charge customers additional amounts after completing the checkout process in the future, and to not publish a “Don’t pay” statement when advertising its products unless the published price is a genuine reflection of the price recently offered by Pet Circle or any other retailer in the market for the same product.

Pet Circle also committed to reimburse all 5,400 customers who were charged a higher price than displayed at checkout, as well as to establish and maintain an ACL compliance program.

This matter indicates that even where false and misleading representations are made to only two customers, which is two customers too many for the ACCC.

The ACCC Wrangles Jeep into a court enforceable undertaking for concerns over consumer guarantee failures

In October 2023, the ACCC accepted a court-enforceable undertaking from Stellantis (Australia and New Zealand) Pty Ltd (Stellantis), the Australian importer and distributor of Jeep vehicles, regarding the way it handles complaints from consumers who experience problems with their Jeep vehicles and their procedures for remedying breaches of the consumer guarantees.

The ACCC began investigating Stellantis after receiving many complaints from consumers about their Jeep vehicles and their difficulties in obtaining remedies under the consumer guarantees in the ACL. These complaints related to lengthy delays in obtaining a remedy, vehicles requiring multiple repairs for the same issues and delays in parts being provided.

Under the ACL, there are numerous consumer guarantees that apply to new and used vehicles sold to consumers, including the guarantee that the vehicles be of acceptable quality and match their description. Depending on the nature of the problem, a consumer may be entitled to a repair, replacement, or refund.

In accepting the undertaking, Stellantis agreed to review its procedures for handling complaints and to make any necessary changes to ensure that consumers who experience a ‘major failure’ with their vehicle are given the refund or replacement to which they are entitled. The undertaking ensures that Jeep customers are better informed about their consumer guarantee rights, by requiring Jeep to provide written information to customers who purchase new Jeep vehicles and/or who seek to rely on their consumer guarantee rights for a remedy.

Stellantis has also undertaken to improve its internal systems and staff training to ensure consumers are not wrongly denied remedies to which they are entitled. Any changes made by Stellantis will need to be reported to the ACCC.

“Ocean plastic” claims fail to hold water: MOO admits to likely contraventions of the ACL for its “100% ocean plastic” packaging

In November 2023, the ACCC accepted a court-enforceable undertaking from MOO Premium Foods Pty Ltd (MOO) following an investigation into MOO’s “100% ocean plastic” representations on its yoghurt packaging, website and social media pages.

MOO, a South Australian-based yoghurt company, claimed that its yoghurt tubs were made from “100% ocean plastic”, which the ACCC alleged gave consumers the impression that they were made from plastic waste collected directly from the ocean, when in fact the plastic resin used in MOO’s packaging was abandoned plastic waste collected within 50km of the shoreline of regions where waste management is inexistent or inefficient.

Whilst MOO included disclaimers on the top and back of its packaging, the ACCC did not consider the disclaimers to be sufficient to overcome the headline misrepresentation. MOO stated in the undertaking that its conduct was likely to have contravened sections 18, 29(1)(a) (goods are of a particular standard, quality, value, grade, composition, style or model or have had a particular history or particular previous use), 29(1)(g) (goods have sponsorship, approval, performance characteristics, accessories, uses or benefits), and 33 (misleading as to the nature of goods) of the ACL. MOO’s three-year undertaking requires it to:

update its packaging design to stop making the ‘100% ocean plastic’ representation and conduct a comprehensive review of its website and social media platforms to ensure all ‘ocean plastic’ claims are removed;

conduct internal audits relating to the nature and location of the ‘ocean bound’ plastic resin used in MOO’s yoghurt product packaging;

establish and implement a compliance program; and

publish a corrective notice on its website and social media platforms, which will remain in place for 60 days.

This is the ACCC’s first greenwashing investigation that has resulted in an administrative outcome (i.e., a court enforceable undertaking), rather than court proceedings since announcing greenwashing as a Compliance and Enforcement Priority in 2022-23 and 2023-24. The ACCC will be announcing its 2024-25 priorities in early 2024.

It is clear the ACCC is continuing to place a significant amount of focus on environmental and sustainability claims by businesses as such claims are considered a key influence on consumers’ purchasing decisions. The ACCC published its final greenwashing guidance for businesses on 12 December 2023, a summary of which can be found on G+T’s website.