Previously we reviewed the Stanford HIA 2024 AI Index’s findings on developments in AI capability in the last 12 months. This week we review the Index’s findings on the global economic impacts of AI over the last 12 months.

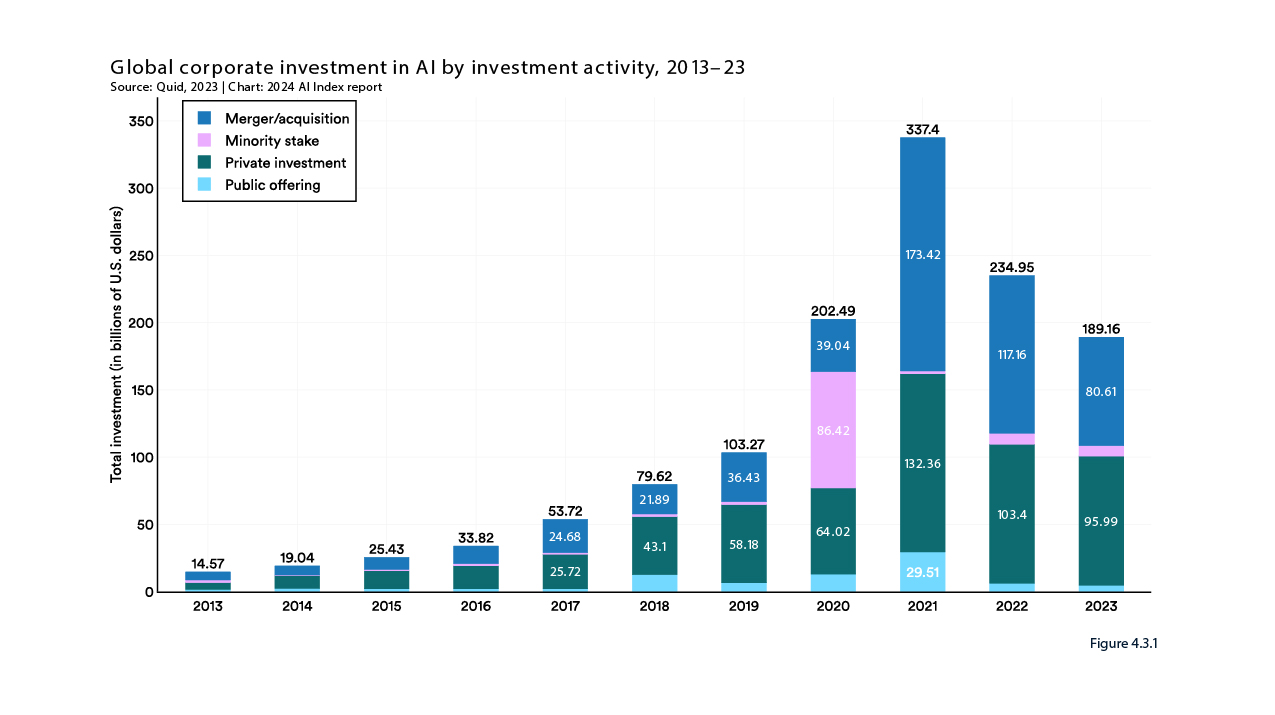

As the figure below shows, global investment in AI has continued to drop significantly, down over 40% from the high in 2021, but still 13x higher than a decade ago.

Most of this decrease was in M&A activity. Private equity investment (measured by AI start-ups that received over $1.5 million in funding) is only down 7% globally in the last 12 months. As a result, PE now accounts for over half of total global AI investment, up from 30% in 2020.Unsurprisingly, AI investment skewed heavily towards generative AI, which attracted $25.2 billion globally in 2023, nearly nine times the investment of 2022 and about 30 times the amount in 2019.

Other findings on start-ups and PE investment in 2023 were:

PE has fallen even more heavily for generative AI than investors in general - while generative AI accounted for 13% of overall AI investment in 2023, it accounted for over a quarter of all AI investment by PE globally in the same period.

the US, far and away, accounts for most PE investment in AI: in 2023, $67.2 billion was invested by PE in the United States, roughly 8.7x the second ranking country, China, and 17.8x the UK.

the average size of PE deals has remained steady at around US$30 million compared to 2021. But this obscures a shift in disaggregated deals: there were declines in the number of small (under US$50 million) and mid sized deals (US$50-$500 million), and an increase in the number of large deals, including 9 deals over US$9 billion, reflecting the growing market value of AI.

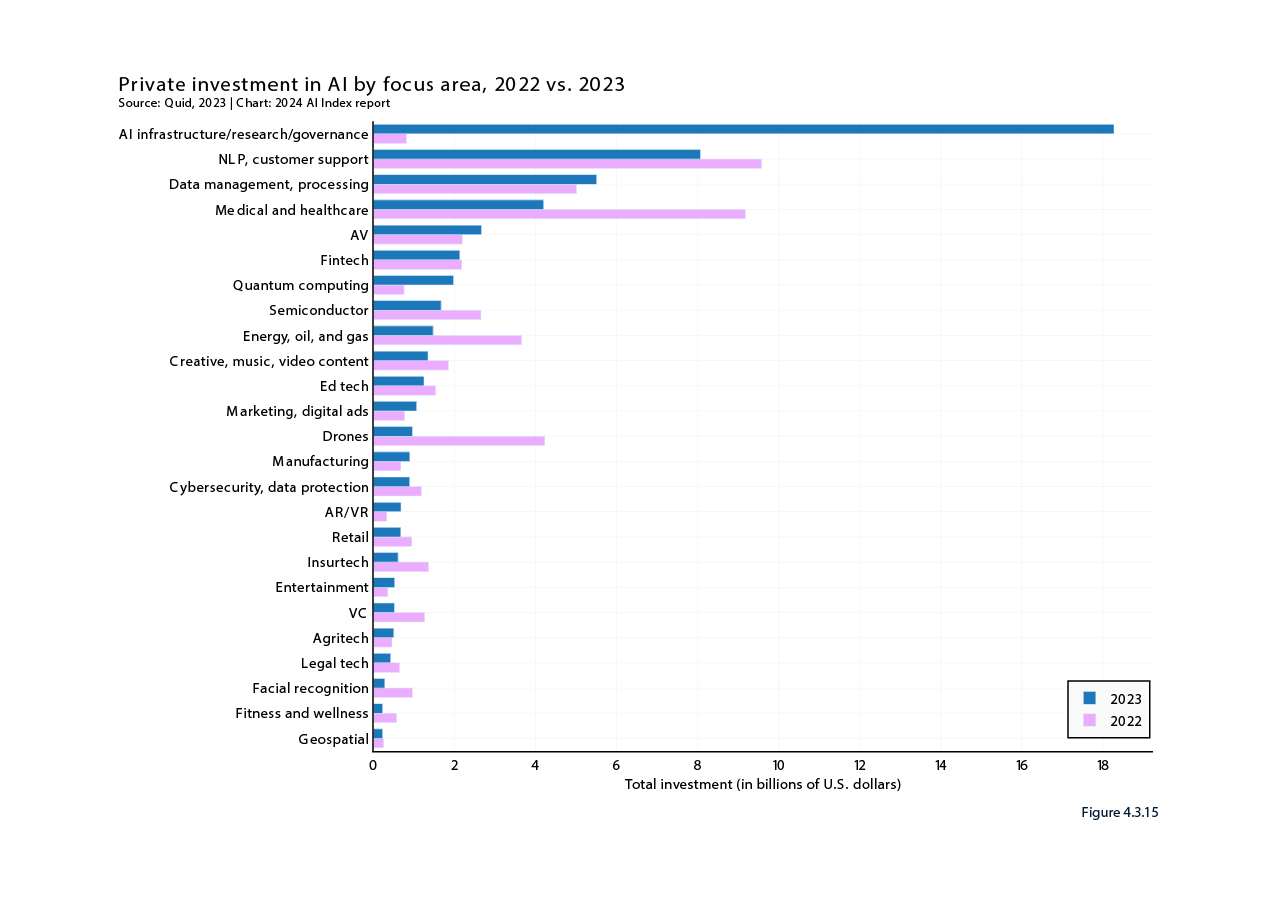

As the figure below shows, there has been a substantial shift in the focus of PE investment into “AI infrastructure/research/governance”, which the 2024 AI Index says “reflects large investments in companies specifically building AI applications, such as Open AI, Anthropic, and Inflection AI.” While there has been a general decline in other focus areas, the decline has been most pronounced in medical and healthcare AI, although there remains a lot of hype around medical AI being one of the first big AI ‘cabs off the rank’.

Business take-up

The 2024 AI Index draws on a McKinsey survey of survey of 1,684 respondents across various regions, industries, company sizes, functional areas, and tenures around the world.

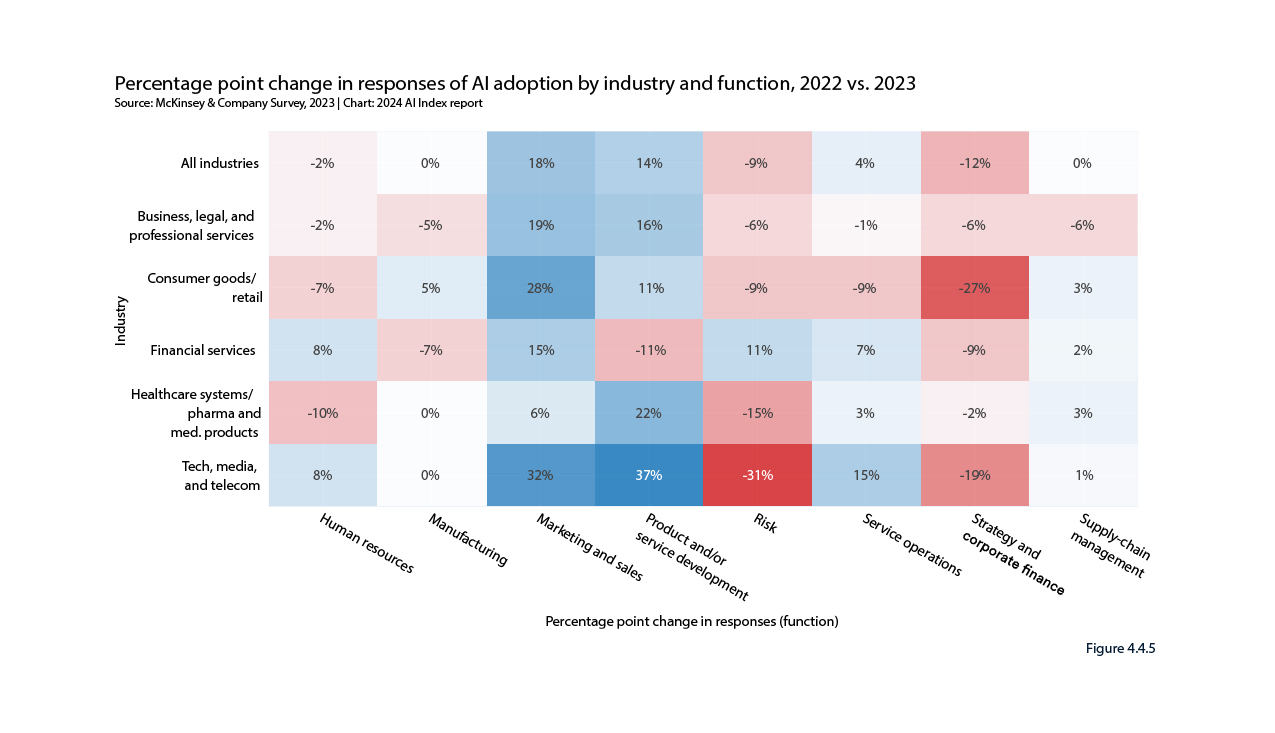

In 2023, over 55% of surveyed enterprises reported using AI in at least one business function, surprisingly only a modest increase of 5% or so in the last 12 months. As the figure below shows, over the last 12 months, most of the growth in AI usage by business is customer facing - marketing and sales - again surprisingly with drops in strategy and corporate finance, risk, and human resources.

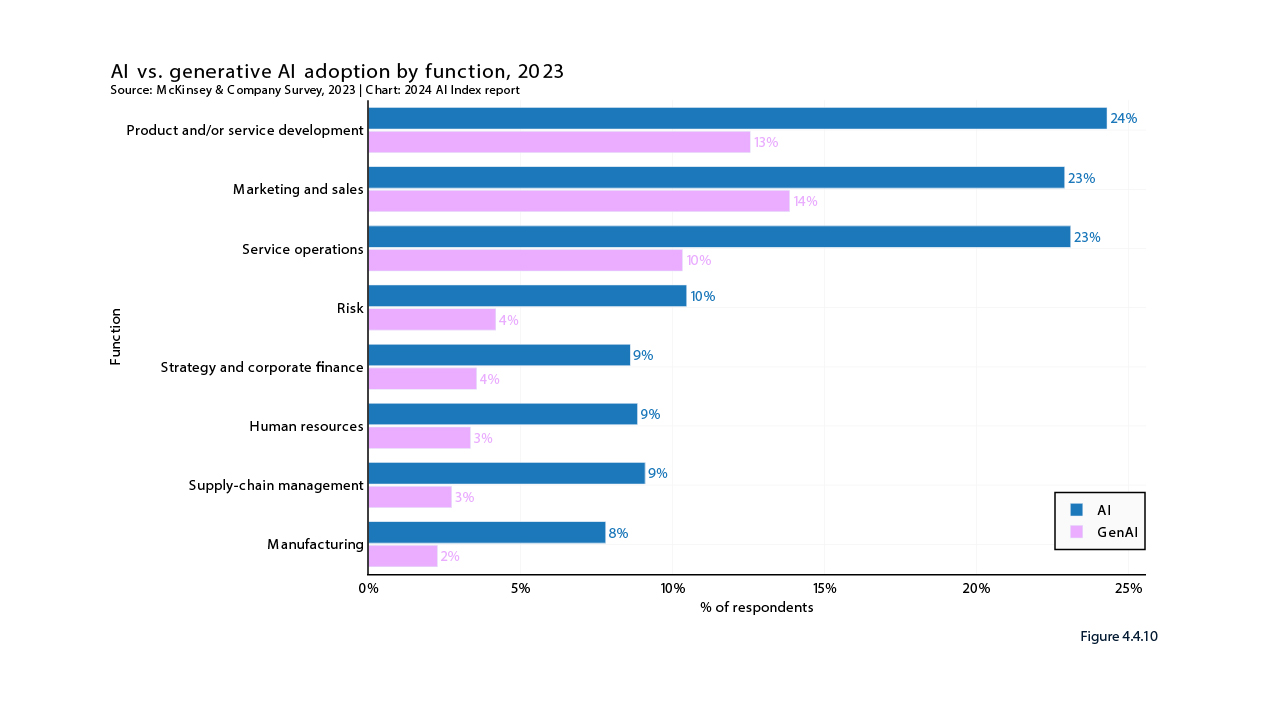

The survey also compared the use of general AI vs generative AI in businesses, and found that, as the following figure shows, that general AI still dominates overall, but generative AI is beginning to “permeate” businesses and that its patterns of usage across functions is pretty similar to general AI.

The survey reports that most of the benefits of AI deployment for businesses skew to cost savings over revenue gains. While 42% of respondents reported cost savings and 59% reported revenue increases, two thirds of those reporting cost savings said the savings were 20% or greater while only 10% said the revenue increases were 10% or greater. This has been the pattern over some time: the 2024 AI Index notes that “[c]omparing this and last year’s averages reveals a 10 percentage point increase for cost decreases and a four percentage point decrease for revenue increases across all activities.”

Employment

The 2024 AI Index sets out some of the mounting research on how AI improves employee productivity:

a Harvard Business School study found that that consultants with access to GPT-4 increased their productivity on a selection of consulting tasks by 12.2%, speed by 25.1%, and quality by 40.0%, compared to a control group without AI access.‘all boats rise with the AI tide’: the same HBS study also showed that:

Lower-skilled (bottom half) participants exhibited a 43.0% improvement, while higher-skilled (top half) participants showed a 16.5% increase. While higher-skilled workers using AI still performed better than their lower-skilled, AI-using counterparts, the disparity in performance between low- and high skilled workers was markedly lower when AI was utilized compared to when it was not.

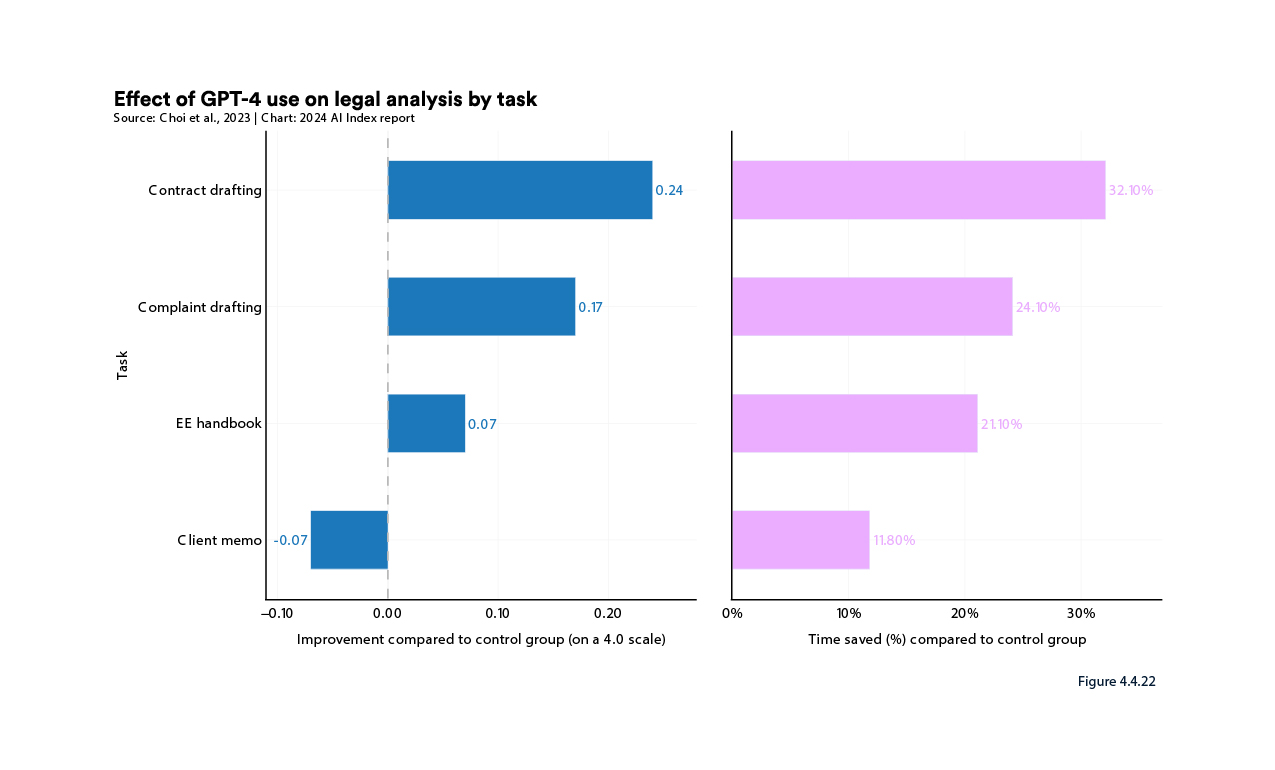

as the figure below shows, another study found that lawyers using AI substantially improved performance in terms of both work quality and time efficiency across a range of tasks:

But there is also the risk of employees falling into a ‘computer says no’ mindset. While a study of professional recruiters reviewing resumes found that receiving any AI assistance improved task accuracy by 0.6 points compared to not receiving AI assistance, those that were told they were using “good AI” (i.e. highly reliable) performed materially worse than those who were told their AI was capable but could make mistakes (“bad AI”). The study theorizes that recruiters using “good AI” became complacent, overly trusting the AI’s results, unlike those using “bad AI,” who were more vigilant in scrutinizing AI output.

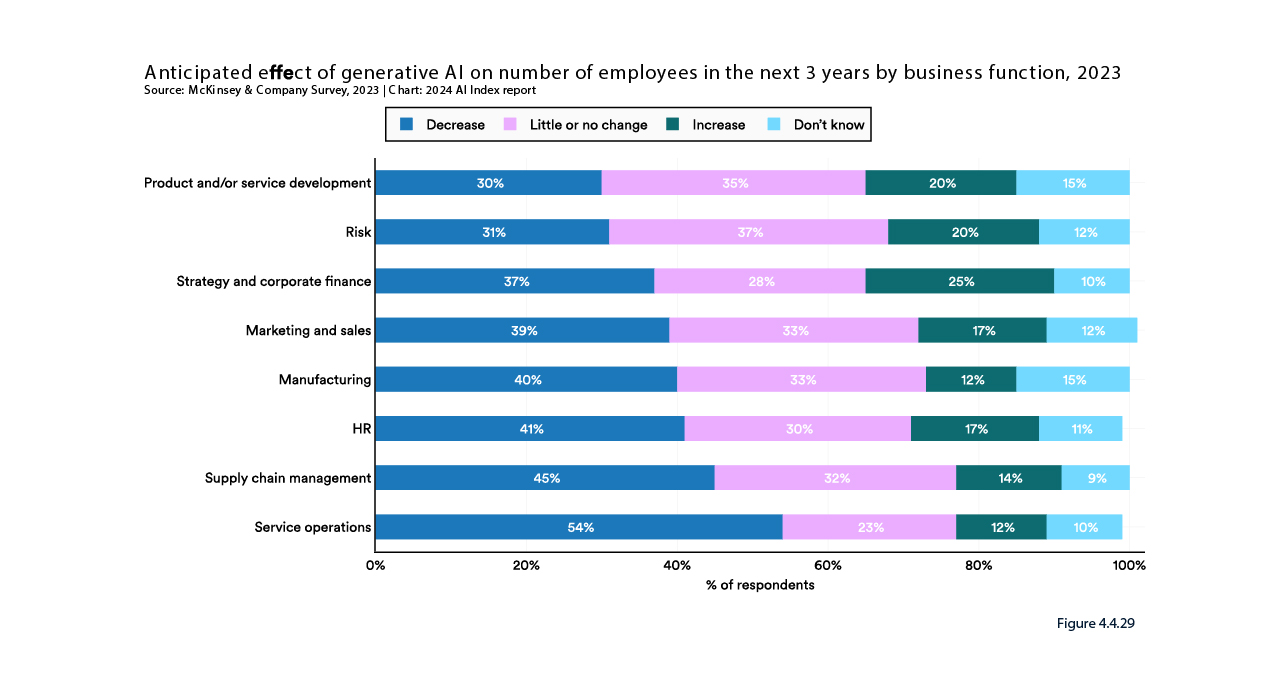

The 2024 AI Index notes that employer perspectives on the impact of AI adoption on employment levels differ between sectors. As the following figure shows, while job losses are anticipated to be higher in service operations and supply change management, more than half of employers expect a small change or growth across many other functions as a result of AI, including sales and marketing, risk management and product and service development.

AI-specific skills remain highly gendered around the world. As the following figure shows, based on a survey of thousands of LinkedIn entries (which itself could have a degree of gendered ‘resume padding’), for all countries in the sample, the AI skill penetration rate is greater for men than women, with India (1.7), the United States (1.2), and Israel (0.9) having the highest reported AI skill penetration rates for women.

How does Australia fare?

In short, Australia ranks low (even relatively given the size of its economy) in most of the 2024 AI Index’s league tables:

Australia has half or less the penetration of AI skills amongst women than the UK, Canada and Singapore, and the gap between male and female skills is 2.5x in Australia compared to 2x in Canada and 2.15x in Singapore.

2023 PE investment in AI in Australia (at US$0.37 billion) is significantly below Canada (at US$1.61 billion, Sweden (at US$1.89 billion) and Singapore (at US$1.14 billion).

in 2023 the number of newly funded AI companies was 29 in Australia compared to 59 in Canada, 43 in Israel and 29 in Singapore.

Australians are amongst the world’s most sceptical citizens about the benefits of AI, with only 40% (a slight improvement over 2022) agreeing in a survey that AI is beneficial overall, compared to 46% in the UK and 64% in Singapore (but we are still less sceptical than the US, France and Canada). Australia also had one of the largest increases globally (18%) in people who said that ‘AI products make me nervous’ (of course, caution is not a bad thing but it can also be a barrier to innovation). By comparison, 43% of Dutch respondents viewed AI products and services positively, up from 33% in 2022.

Australia does comparatively well in some other measures:

Australia has 84 university level AI courses, compared to 80 in Germany and 37 in Sweden.

Australia ranks fairly highly in the number of AI patents: Australia has 1.91 patents per 100,000 people compared to Germany at 0.66 and tech savvy Finland at 0.56. This also might suggest some strength in Australia’s university sector and publicly funded organisations such as the CSIRO where much of the AI research occurs.

AI-specific advertised jobs as a percentage of total jobs advertised in Australia are about 1% compared to 0.85% in the UK and 0.81% in Germany, with Australia, Canada, Singapore, and India experiencing the biggest upticks in AI hiring globally in 2023 (Australia at 6.53%).

Read more: The AI index report 2024 - Measuring trends in AI