22/10/2018

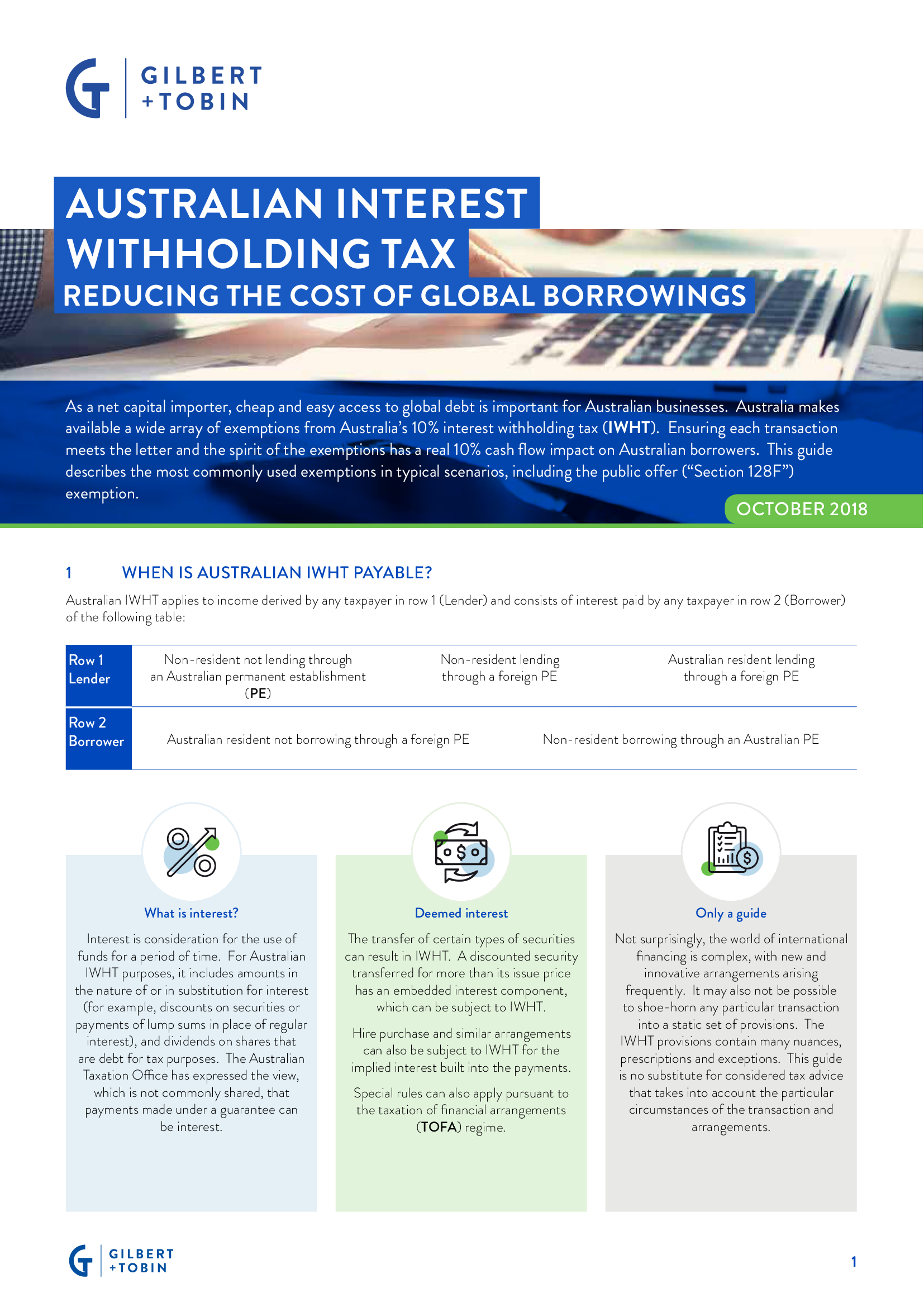

As a net capital importer, cheap and easy access to global debt is important for Australian businesses. Australia makes available a wide array of exemptions from Australia’s 10% interest withholding tax. Ensuring each transaction meets the letter and the spirit of the exemptions has a real 10% cash flow impact on Australian borrowers. This guide describes the most commonly used exemptions in typical scenarios, including the public offer (“Section 128F”) exemption.

This article examines:

- When is interest withholding tax payable?

- Navigating the public offer exemption

- Treaty exemptions

- Other exemptions

Expertise Area

Visit Smart Counsel

Subscribe to receive our latest articles and insights.