On 7 June 2023, the Australian Government released its Strategic Plan for Australia’s Payments System (Strategic Plan), outlining the Government’s policy objectives and priorities for reform. The Strategic Plan follows the Treasury’s recent consultation on proposed priorities and reform objectives, with an agenda focused on:

promoting a safe and resilient system;

updating the payments regulatory framework;

modernising payments infrastructure;

uplifting competition, productivity and innovation across the economy; and

keeping Australia as the leader in the global payments landscape.

The Government notes its principles to guide the future direction of Australia’s payments framework are ‘trustworthiness ’, ‘ accessibility innovation ’ and ‘efficiency ’. This is underpinned by the increasing digitisation of Australia’s payments systems, driven by consumer preferences for frictionless transactions and evolving technology. The Strategic Plan comes after over four separate payments system reviews in recent years and the previous Government’s commitment to implementing the majority of those recommendations (see our update 'Australian Government gives nod to payments and crypto reform').

Key Priorities and Initiatives: Unpacking the Government's Strategic Plan

As noted, the Strategic Plan sets out five categories of the Government’s key priorities and supporting initiatives.

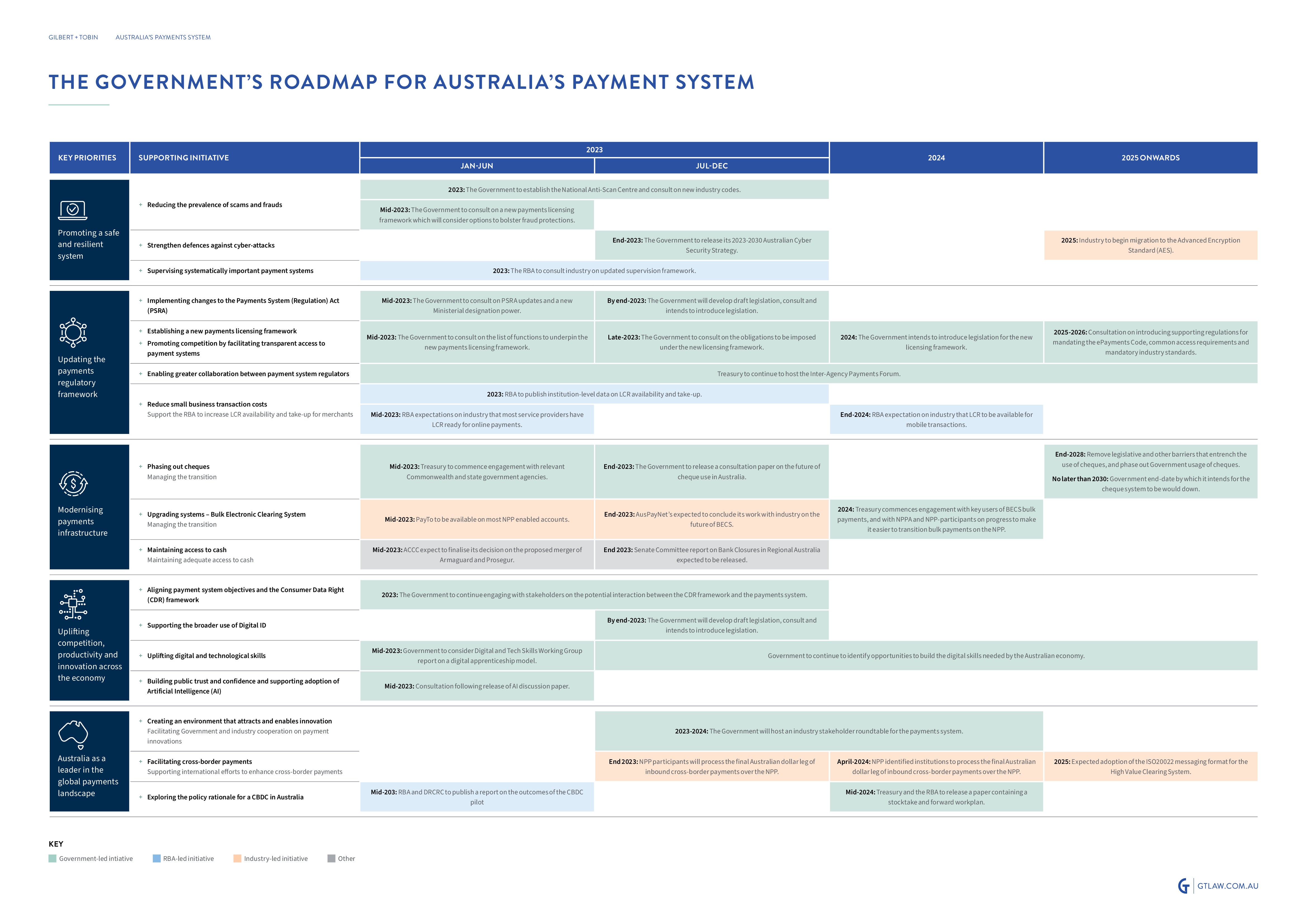

Roadmap for Australia’s Payments system

As part of the Strategic Plan, the Government provided guidance regarding the rollout of its proposed supporting initiatives.

Considering options: Strategic Plan's Long-Term Impact on Payment and Payment Technology Providers

Many of the proposals in the Strategic Plan are not new, but reaffirm the Government’s previous commitments to recommendations in various payments reviews over the years. However, some proposals have the potential to radically impact the regulatory touchpoints for payment and payment technology providers in the longer term. While these areas are subject to further consultation, payments providers should consider the potential impact for their business and whether participation in Treasury consultations would assist in shaping any future reform.

For more information on Payments in Australia, visit our guide . Please reach out should you wish to discuss.

KNOWLEDGE ARTICLES YOU MAY BE INTERESTED IN:

Treasury consults on Payments System Strategic Plan

Australian Government gives nod to payments and crypto reform