The Australian Government has recently introduced its new Payment Times and Reporting Scheme (the Scheme) by passing the Payment Times Reporting Act 2020 (Cth) (the Act) and Payment Times Reporting (Consequential Amendments) Act 2020, which commence on 1 January 2021. The Payment Times Reporting Rules (the Rules), which also form part of the Scheme, were made available on 25 November 2020.

Broadly, the Scheme requires large entities to report their standard payment periods to a regulator twice yearly, and this information will be published by the regulator on a public register. The Scheme is intended to create greater transparency around the payment practices of large entities, so that small businesses may make more informed decisions about the large customers they supply to. Indirectly, the Scheme aims to shorten the time that it takes large entities to pay small businesses.

Do I need to report under the Payment Times Reporting Act 2020 (Cth)?

The test for whether an entity is required to report is not straightforward. While this likely reflects the legal acrobatics required to ensure the Act fits within Parliament’s powers under the Constitution, one wonders whether a simpler approach could have been adopted (for example, compare the concept of a reporting entity under the Modern Slavery Act 2018 (Cth)).

We’ve attempted to simplify the “reporting entity” test as follows:

- Australian corporations or foreign entities operating in Australia with a total income over $100M;

- Australian parent companies (with no further Australian parents themselves, although they might have foreign parents), where the Australian group’s total income is over $100M; and

- Australian corporations that are members of an Australian Group where the Group’s total income is over $100M and the corporation’s total income is over $10M.

The income tests are based on the immediately previous tax year and what you included on your tax return.

These tests also apply to:

- corporate Commonwealth entities and Commonwealth companies (that is, certain entities controlled by the Commonwealth Government); and

- partnerships and unincorporated associations or body of persons that carry on an enterprise in a Territory.

Registered charities are not required to report under the Act.

Please note that the above is a simplification of the tests under the Act, and necessarily excludes some detail. The actual test provided for in section 7 of the Act can lead you down a rabbit warren of references in the A New Tax System (Goods and Services Tax) Act 1999 (Cth), Income Tax Assessment Act 1936 (Cth), Income Tax Assessment Act 1997 (Cth), Public Governance, Performance and Accountability Act 2013 (Cth), Tax Administration Act 1953 (Cth) and Corporations Act 2001 (Cth). So, if you are not sure if you qualify, you should check the Act.

Reporting requirements imposed by the Payment Times Reporting Act 2020 (Cth)

The Act requires reporting entities to give the Payment Times Reporting Regulator (Regulator) a payment times report for each half of their income year (reporting period). The payment times report must be provided to the Regulator within 3 months of the end of each reporting period, and must include certain content such as:

- the standard payment periods of the reporting entity, including the shortest and longest standard payment periods;

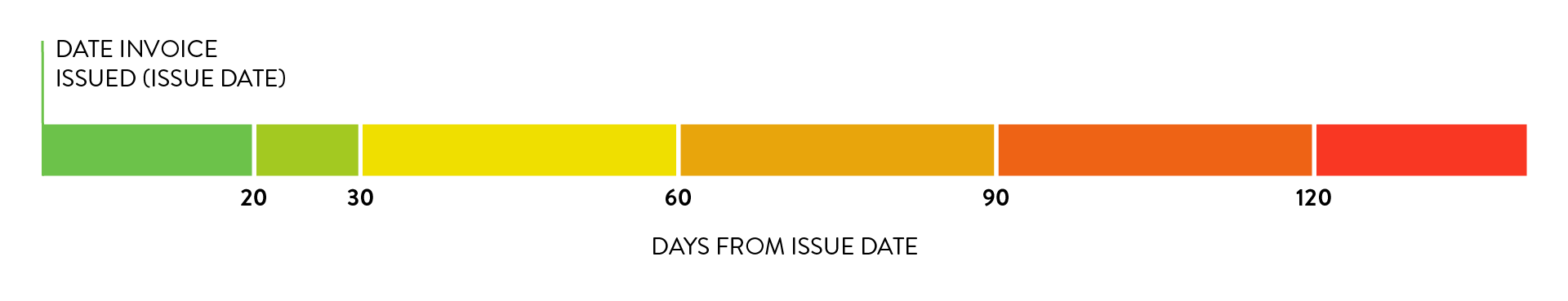

- the proportion (determined by total number and total value) of small business invoices during the reporting period that were paid by the reporting entity within the following ranges; and

- the proportion (determined by total value) of all procurement by the entity from small business suppliers during the reporting period.

The term “standard payment period” refers to the payment period on offer in the reporting entities’ contracts with its small business suppliers or if no payment period is on offer, the payment period most commonly included in the reporting entities’ contracts with small business suppliers.

Reporting entities must keep records of any information used in the preparation of a payment times report for at least 7 years after the end of the applicable reporting period.

Tool for identifying small business suppliers

The reporting requirements will be supported by the Payment Times Reporting Small Business Identification Tool, which the Government plans to make available to entities by December 2020. The tool is intended to reduce the compliance burden for reporting entities by ‘automating’ the process of identifying small business suppliers.

Entities will be able to enter information about their suppliers and the tool will identify whether that supplier is a small business or not. Under the Act, the tool will identify a business as a small business if it carries on an enterprise in Australia and its annual turnover was less than $10 million for the most recent income year.

Payment Times Reporting Regulator

The Regulator (to be appointed by the Secretary of the Department of Industry, Science, Energy and Resources) will administer the Scheme and publish submitted reports on a central public register known as the Payment Times Report Register (the Register).

The Register will be made available online for public inspection, free of charge.

The Regulator may choose not to publish certain information on the Register if it considers that making the information publicly available would be contrary to the public interest. In making this decision, the Regulator must consider whether the information is commercial-in-confidence (i.e. releasing it would cause competitive detriment to a reporting entity), personal information (as defined by the Privacy Act 1988 (Cth)), and any other matters prescribed by the Rules.

The Regulator also has monitoring and investigation powers and can require a reporting entity to arrange an audit of its compliance with the Act. The Regulator can also issue infringement notices in circumstances where it believes on reasonable grounds that an entity has failed to comply with a civil penalty provision of the Act.

Penalties

Significant penalties apply for failing to comply with the Act. For example, reporting entities will be liable to pay the following civil penalties for certain contraventions:

- 60 penalty units ($13,320) for failing to provide a payment times report to the Regulator within 3 months of the end of the reporting period for the income year;

- 60 penalty units ($13,320) for failing to comply with an audit notice issued by the Regulator;

- greater of 200 penalty units ($44 400) or 0.2% of the entity’s total income in the relevant income year for failing to keep records of any information used in preparing a payment times report for at least 7 years after the end of the reporting period;

- greater of 200 penalty units ($44 400) and 0.2% of the entity’s total income in the relevant income year for failing to provide the appointed auditor with all reasonable facilities and assistance necessary for the auditor’s duties; and

- greater of 350 penalty units ($77 700) or 0.6% of the entity’s total income in the relevant income year for providing false or misleading information to the Regulator.

Note that each civil penalty provision will not commence until 1 year after the commencement of the Act on 1 January 2021 (i.e. the penalties will not be enforced until 1 January 2022).

Additionally, if the Regulator is reasonably satisfied that a reporting entity has failed to comply with the Act, it may publish the identity of the entity and details of its non-compliance on the Register, and in any other way that the Regulator considers appropriate. The Regulator is required to give the entity notice in writing of the proposed decision and invite the entity to make written submissions before publishing the non-complying entity’s details on the Register. Additionally, the reporting entity can apply to the Regulator for review of a decision to publish its details on the Register.

Effects of the Payment Times and Reporting Scheme on large entities

The new requirements to report on payment times and practices impose a significant compliance burden on large businesses, which will increase the cost of operating in Australia. The legislative scheme is relatively complex, with dense legislation and supplementary Rules making compliance more difficult than it needs to be. That said, we note that Guidance has been published by the Government.

According to the Explanatory Memorandum to the Act, compliance costs for reporting entities are estimated to increase by an average of $22.5 million per year, on an annualised basis.

As a priority, businesses operating in Australia should assess whether they will be a reporting entity under the Act and prepare for the Scheme’s implementation in the new year.

Where any of the above is lacking, focused effort is required as soon as possible to enable compliance with the new Scheme and to avoid penalties.

Visit Smart Counsel